Rahul was very happy that day. And Why Not, after all, it took him so many years of hard work when he finally was able to call himself a specialized doctor. He always wanted to be a Cardiologist, like his Father. But somehow it took him more than normal time to get there.

It happens, when the goal is so worthy, it’s ok enough to wait.

Now he has started working in a Big Reputed Private Hospital. Though, he had already started earning in the Senior Residency years and but now things are going to be different. Income has multiplied. And in his first year only he has started getting three times the Monthly Income he used to earn in residency years.

But last month when I went to meet him, he was looking worried and depressed. On asking the reason he told me how his income is getting deducted in the name of Income Taxes.

To add to his pain, he told me that his Chartered Accountant wants him to deposit more taxes on the income generated out of his other investments.

That was a Genuine and is always the first concern of any beginner in the financial world.

With high income, you have to accept High taxes.

Everyone who’s earning well wants to save the maximum tax possible. and thus the moment one starts earning, they start looking for ways to save taxes. And why not, after all the money you retain as a result of tax saving can earn more money for you. Money saved is money earned, works on the tax front too.

But with the wrong guidance, doctors always get into some unwanted products in the name of tax saving like Insurance policies. and due to their stable income they sometimes prefer or encouraged to get into home loans just to save Income taxes.

It’s not wise to get into any kind of loan at this stage, as you have yet to build your Good Financial habits, for long term wellness. and neither you require any Life Insurance policy when you do not have any financial dependents.

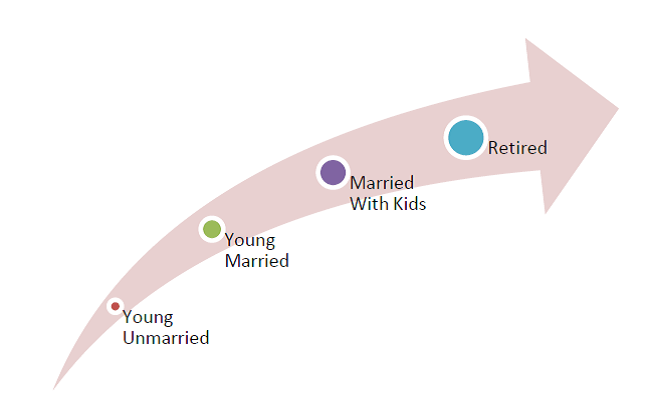

This article is about how a young doctor should start thinking about tax-saving aspects. I will be writing a series of articles on this topic to cover all different life stages of the doctor and how they should look at their tax-saving by keeping the financial Planning intact.

Though you can’t save on every tax penny, yes through intelligent tax planning you can save a lot of taxes.

There are 4 rules in Tax planning which if followed prudently in different stages of life; will save considerably on taxes.

A) Spreading the Taxable income among various family members.

B) Taking full advantage of tax exemptions available.

C) Taking full advantage of tax deductions available

D) Optimum use of Tax-exempted income.

(Also Check: Income Tax Deductions for FY 2020-21, Infographics)

It may not be necessary that you can apply all strategies on your personal financial profile, but you can take it as for your basic understanding which you can discuss with your employer and tax consultant and to find the suitability of these in your financial profile.

Tax Planning Strategies for Young Single doctors

This is the stage when one starts off with a new job and entered a financial life. In a doctor’s life, like in Rahul’s, it was started when he entered into the residency, and ideally, that be the time to start thinking on these lines.

But as they say, Better late than never. This is the age when one starts building financial habits, so one has to be serious on the financial front too.

At this stage, there is only a single tax file to take care of.

Income is generally good for a single doctor with less time to spend and thus have high savings potential unless one is already serving some loans, or get into some.

The following are some of the ways doctors can save income tax through tax planning.

1.) Negotiate with your employer on the breakup of your salary structure. There are many companies which ask the employees in April to design the salary structure themselves suitable to their individual financial profile. They call it a Flexible benefits plan.

Make the most of this opportunity. Sit with your planner, CA or any other Tax professional and find out what amount of HRA benefit is suitable for you, what should be the different allowances that can be added to this breakup. (Read: all you want to know about House Rent Allowance)

Your employer may also want you to select which Income Tax regime you want to follow and get your TDS deducted, so that also needs to be decided well in advance and with proper thoughts.

If given an option, you may also ask your Employer to start contributing to the New pension Scheme on your behalf to reduce your in-hand salary and thus help in tax saving. (Read: New Pension scheme-Should Doctors opt for it?)

2.) Invest the maximum amount allowed for tax saving u/s 80C and 80D, and other permissible sections. Section 80D is for health insurance. Even if your employer has provided you with some coverage it is advisable to have a separate cover. (Read: don’t ignore health insurance).

3.) Stay away from Loans. Yes, even if that gives you some additional tax saving like a Home loan. As I said this stage is all about building Good Financial habits and living on a loan is a worse one. You will be pitched by so many easy loan options, to tempt you to make this mistake. But Beware, All that glitters is not a Gold.

If you really want to buy Home for yourself and is one of an important goal for you, then better to save at least 40-50% of the property value and then take a loan for half of the amount.

Do remember that tax saving should not be at the cost of bad habits, having long term repercussions.

4.) Invest in tax-efficient instruments only like Employee provident fund, Voluntary provident fund, Public provident fund, etc.

Though Insurance plans also give tax-free income I will not advise to invest in Insurance plans due to the basic structure of those products, and the costs associated. ULIP and Endowment policies are the first few options that will come in front of you while searching for investments. If you do not have any financial dependents, practically you do not need any life insurance cover.

If at all you have to buy any insurance policy, better to go with term insurance plans.

4.) If you are in the habit of giving donations or charities then do take the receipt of that amount. This will also help in saving taxes u/s 80G. Plus this may ensure that the organization you are giving money to will put it in a system and proper use, which otherwise may have the chances of being misused when given in cash.

5.) If you want to save for your near-term goal which is not possible through EPF/PPF/Equity funds or any other Tax-free investment option for that matter, then it’s better to gift the amount to your parents or sister, or any other family member who comes in the lesser tax bracket than you and invest in their name.

Gifting to a Blood Relative is tax-free for the receiver.

6.) Don’t let your taxable income increase by keeping the amount in your savings bank account and bank fixed deposits, in the name of Safety.

You need safety or calculated risk that depends on your Risk capacity and Risk required. But for now Just keep the amount required for an emergency in your savings account, for all other parking of funds use Debt mutual funds and select as per your short and medium-term needs. (Ask us for suitable options)

As I always say that Tax planning and Financial planning should go hand in hand, so whatever you do for tax saving should support your long or short-term goals.

In another article, I had also shared Tax planning strategies for young doctor couple. You may check it out here.

Do share if you have any other tax planning strategies to save tax at this Young life stage. It will be beneficial for other young doctors.