New pension scheme, National pension scheme, National pension system, or whatever name you call it with are all the same. This article is to share with you the details of the product.

The new pension scheme is a defined contribution scheme started by the Government of India for the central government employees except for the Armed Forces, who joined employment on or after 01 January 2004; gradually state governments also adopted this system.

Defined contribution means that unlike the old pension system where the employee does not visibly contribute anything towards his/her Old age Post Retirement pension and gets half of his salary at the time of retirement as monthly pension, in the new system the employee and employer (government) will make a defined contribution/deposit in the scheme (which is 10% of basic+DA) and at the time of retirement the pension/annuity can be purchased with the accumulated corpus in this account.

With Effect from 1st May 2009, NPS is available to all citizens of India, including Practicing doctors who can contribute on a voluntary basis.

NPS is a good product and slowly gaining popularity. The Indian Government is leaving no stone unturned to promote NPS.

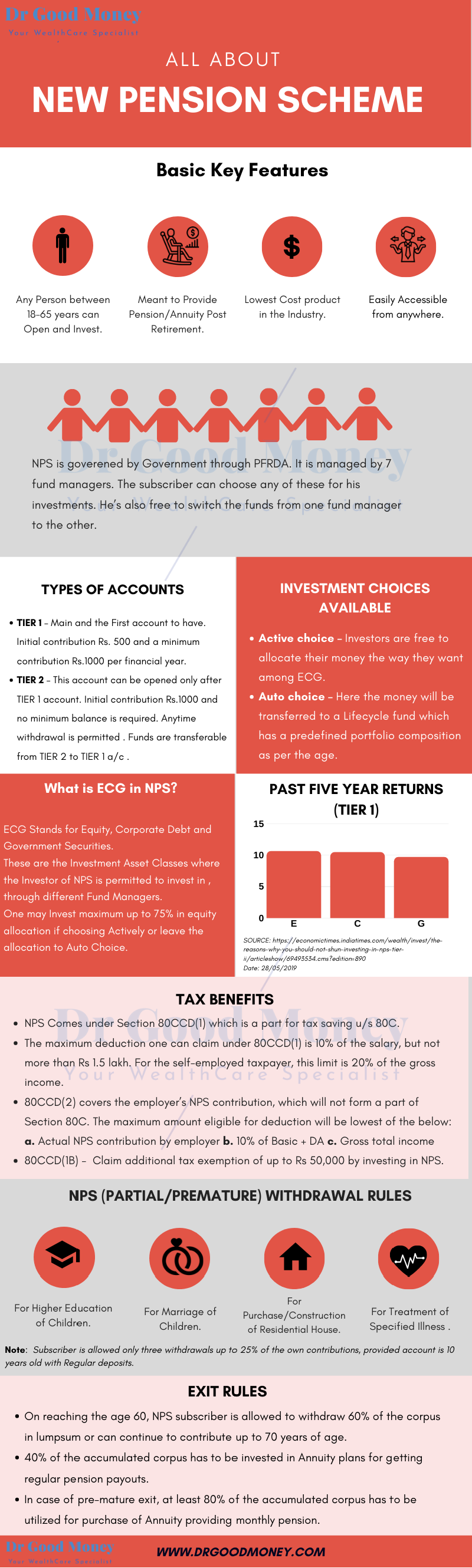

NPS details – Basic Features of New Pension scheme:

- NPS is regulated by PFRDA. As SEBI is for Stock markets and Corporates, RBI is for banking, IRDA is for Insurance companies…the same way PFRDA (Pension Funds Regulatory and Development Authority) is for NPS. So don’t confuse this with another insurance company’s product.

- It is Open to All citizens of India in the age bracket of 18 – 60 years.

- The minimum contribution required is Rs 1000/- annually, with no limit on a number of transactions (there are charges per Transaction).

- The initial and minimum amount per contribution is Rs 500/-.

- As this is strictly a pension product, so subscriber compulsorily has to Purchase life annuity with some specified restrictions/flexibility.

- It is a very lost cost product. With a fund management charge of just 0.0009%, this product is perhaps the world’s lowest-cost pension scheme.

- Investment can be made in different Asset classes through 7 fund managers.

The working mechanism of New Pension Scheme:

It is very simple. It requires regular yearly/monthly/quarterly contribution from the subscriber and on maturity subscriber has to transfer the specified minimum corpus to any IRDA regulated Life insurance company to Purchase Life Annuity and balance can be withdrawn in a Lump sum.

NPS details – Types of Accounts in New Pension Scheme:

TIER 1 – This is the First account that any subscriber has to opt for. Withdrawal in this account is permitted as per the above chart.

TIER 2 – This account can be opened only after TIER 1 account. Anytime withdrawal is permitted through this account. You may also transfer the funds from TIER 2 a/c to TIER 1 but not the other way round.

NPS details – Investment style and Asset Allocation in New pension scheme

Pension Portfolio Fund Managers

Right now there are 7 fund managers appointed under the “All Citizens account” category. The subscriber can choose any of these for his investments. He’s also free to switch the funds from one fund manager to other without any extra charge.

- Birla Sun Life Pension Scheme

- HDFC Pension Fund

- ICICI Prudential Pension Fund

- Kotak Pension Fund

- LIC Pension Fund

- SBI Pension Fund

- UTI Retirement Solutions

The fund managers may keep changing or stay the same as per the new criteria and costs structure laid down by the government from time to time.

What is ECG in NPS?

Every portfolio fund manager has to manage the money in 3 separate accounts having separate asset profiles. Here E stands for Equity, C stands for Corporate Bonds and G stands for Government securities.

Asset Allocation

There are 2 choices available for subscribers.

Active choice – In Active Choice, you can choose the asset mix among four asset classes as per your choice – Equities (E), Corporate debt (C), Government securities (G), and Alternative Investment. With the recent changes, the maximum permitted allocation to E has now been enhanced to 75% up to 50 years of age. From 51 years onwards, the maximum equity allocation allowed will keep reducing by 2.5% per annum, and become a maximum of 50% at the age of 60. Prior to this change, the exposure to E was capped at 50% of the portfolio.

Auto choice – Here, the money will be invested in asset classes – E, C, and G – in defined proportions based on your age. As an individual’s age increases, exposure to Equity and Corporate Debt is gradually reduced and that in Government Securities is increased. Depending upon the risk appetite of the subscriber, there are three different options available within Auto Choice-Aggressive, Moderate and Conservative.

- Aggressive (LC-75) – Maximum Equity exposure is 75% up to the age of 35.

- Moderate (LC-50) – Maximum Equity exposure is 50% up to the age of 35.

- Conservative (LC – 25) – Maximum Equity exposure is 25% up to the age of 35.

(Also Read: Asset Allocation- the balanced diet to your portfolio.)

NPS details – Taxation aspects in New Pension Scheme

The taxation aspect is very interesting to understand and if used properly it will help in a decent reduction in tax payment.

This is covered under Section 80CCD of the income tax act, which says

Deduction in respect of contribution made by an individual in the previous year to his account under a notified pension scheme is allowed in the computation of his total income –

a) In the case of an employee, for instance, a doctor working in a hospital, 10% of his salary in the previous year.

b) In any other case, a doctor having his own clinic, 10% of his Gross Total Income in the Previous Year.

It is further clarified that the aggregate limit of deduction under this section along with Section 80C, 80CCC shall not, in any case, exceed Rs 1.5 lakh.

Where the central government or any other employer (hospital) makes any contribution to the account of the employee (doctor) for the pension scheme, the assessee shall also be allowed a deduction in the computation of his total income of the whole of the amount contributed by the central government or any other employer, provided it does not increase 10% of his salary (Basic +DA).

(Also Read: Tax Planning tips for Young Doctors)

Any contribution made by a subscriber in NPS a/c in a financial year will be eligible for tax benefits up to Rs 1.5 lakh u/s 80CCD, subject to the overall limit of Section 80C. W.e.f April 2015, there’s a new section added in IT act 80CCD(1b). Now you can save tax over and above the Section 80C limit, by investing a maximum of Rs 50000 in New pension scheme account.

Further, as per Section 80CCD (2) of income tax act says W.E.F 1st Apr 2012 up to 10% of the salary (basic and dearness allowance) of employers Contribution can be deducted as ‘Business Expense’ from their Profit & Loss Account.

Thus, if you can negotiate with your employer on salary break up or increment at the time of appraisal, you may include NPS contribution by the employer in your total CTC. This will help you in a significant reduction in tax payment. You can make use of this change from your Retirement planning purpose.

(Also Check: Income Tax Deductions for FY 2020-21, Infographics)

Pros and Cons of the New Pension Scheme

Pros

- The low-cost structure has definitely made it a product to consider.

- Additional Tax saving u/s 80CCD (2) an employer’s contribution is another attractive option.

- Flexibility on part of investors on asset selection and choice of 7 fund managers with a good track record.

- This account is completely portable. Unlike other products like PPF/EPF where you have to get the account transferred the time you change your job to some other place, this account is accessible everywhere in the country with the same account number.

Cons

- Taxation on withdrawal at maturity is the biggest disadvantage in choosing this product. However, as per budget 2016, FM has allowed 40% of withdrawal on maturity as tax-free. In Budget 2019, the whole withdrawal of 60% is declared tax-free.

- Data on the performance of fund managers and respective schemes is not readily available. However, there are some media houses that track the performances and share every week in their publications. But now you can go to the NPS Trust website to view the scheme performances.

- Restriction on Allocation may be unacceptable to some.

- Not so flexible in pre-closure or prematurity withdrawal.

Conclusion: Should you invest in New Pension Scheme?

Now you have gone through all the NPS details. You can see that the low-cost structure and now the tax exemption on the employer’s contribution have made this product a very attractive one. Otherwise, all other features can be brought in the portfolio through other products with proper investment planning.

Tax at maturity used to be a big drawback in this, but in budget 2019, the whole 60% lump-sum withdrawal was declared tax-free by the Govt and the extra tax benefit u/s 80CCD(2) makes it a must-buy option. I feel that if one is a disciplined investor and has done proper Retirement planning then he may include some portion of his investments into this.

Good Article. Well explained.

But could you please guide me on how to invest in NPS? I am not that tech-savvy.

Thanks.