Parul, a medical student emailed me and asked how one would figure out which Asset allocation is best for her, and as investment value keeps on changing, how would one ensure that the Asset allocation stays intact for the complete investment tenure.

There was no one-line answer to this so I decided to write a detailed post on this subject which I believe will benefit other readers too.

What Is Asset Allocation?

In simple terms asset allocation is dividing the investment amount among different unrelated investment asset classes with a goal of minimizing the volatility and optimizing returns.

Unrelated assets mean those which do not respond to the same market forces in the same way at the same time. This may lead your investments to gain on one front when the other side is losing (it may not happen always, but over a longer period of time it works like this only)

It is just like having a balanced diet with the goal of taking all nutrients our body requires to stay healthy.

Asset allocation is a must to keep your investments healthy. With a lure of earning more return, one has a tendency to move into more of stock market investments in the bull market phase but this portfolio starts bothering in the volatile phase.

In a volatile environment, investors tend to move towards safe assets but under high inflation scenarios and low post-tax returns, they could not achieve their goals.

So having a proper mix of different asset classes is what one requires.

(Also Read: 5 Risks Doctors are exposed to and how to manage them)

How to decide ideal Asset Allocation?

The common misconception among people is that they decide the suitable asset allocation as per their Age. Well, this is not only their fault…many advisers or investment houses also works in the same fashion.

They say 100 minus age is what you should have in equity (aggressive) and remaining in debt (Defensive). But this is the wrong strategy.

I believe even 70 years old person can have a risk tolerance of investing 80% in equity if he’s having an arrangement of regular income and have surplus funds available with him with no goals targeted. So believing in “age funda” for asset allocation may prove to be lethal for investments. However, it is fine for novice and beginners.

See asset allocation is a factor of your risk profile. The risk profile is something which tells how you generally react to different market and real-life situation. Your perception towards an investment might change for the short term but your inherent behavior towards risk will always remain the same.

Another factor that affects your asset allocation is the goals targeted. Even if you are high on risk tolerance but your goal is just 2 years away then there’s no point in going for aggressive allocation

How to determine your own asset allocation?

1. Understanding different Asset classes– This is the first and very important point. One has to understand that in India there are only 4 asset classes to invest in. Equity, Debt, Gold, and Real estate.

Equity and Real estate come under aggressive and volatile asset classes whereas Debt and Gold are somewhat safer and less volatile.

All these asset classes can be invested in directly or through Mutual funds or Portfolio management routes. Even Insurance ULIPs provide you exposure to different asset classes.

So whatever investment instruments you have, you are invested in these 4 asset classes only. For e.g. If you have 4 endowment/money-back insurance policies, PPF a/c. bank and corporate fixed deposits, RBI saving bonds, etc. All these collectively result in your debt allocation.

2. Understanding your Risk profile – As I wrote above, your risk profile doesn’t just come out of your age, it is how you generally react to different situations.

Are you in a habit of taking chances with your money? At what speed you drive your vehicle- do you wear seat belts, do you use mobile phone while driving? do you favor a fixed salary with less bonus or a low salary with a high bonus, etc?

All these real-life instances collectively form your risk tolerance attitude in investments. Risk profiling is like knowing one’s blood pressure level and thus sensitivity to volatility. (Read: Risk Profiling- The BP check before investing)

Doing proper risk profiling is one of the regulatory requirements for SEBI registered investment advisers which include many banks too. So if you are dealing with a registered adviser he will take care of this part.

3. Knowing your goals – Relying totally on your risk profile sometimes may not be the right strategy for you, but it doesn’t even mean you can ignore it.

As the ultimate requirement is to achieve the goals comfortably so as you reach near to the goal you should move from aggressive to conservative.

If you have invested heavily in equity or real estate for a goal targeted, then you should be out of these assets at least 2-3 years before the target year…even if you are very bullish on market performance 😉

When should Asset allocation be rebalanced?

Over a period of time, with an increase in the value of your investments, you will find that the ratio of your allocation has changed. You may find yourself again high on equity or high on debt.

So timely rebalancing of your investment allocation is very important. You can do the rebalancing by selling one asset class and buying the other with the same amount, or if you have surplus funds available with you, you may make some additional purchase in the asset where the value has gone down.

Let’s understand this with an example:

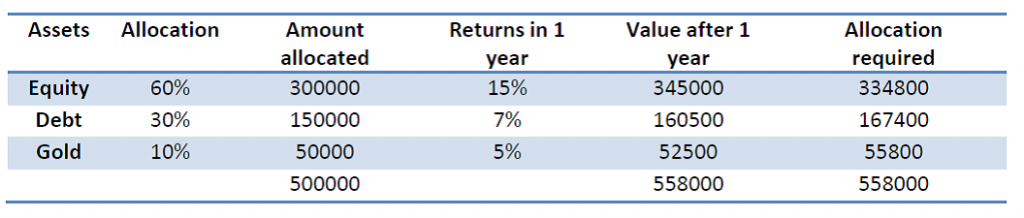

Say you have Rs 5 lakh with you as surplus available and after going through the risk profiling process your advised asset allocation comes out to be 60% Aggressive and 40% defensive.

The above chart shows that now to rebalance the allocation suitable to your risk profile, you need to sell Rs 10,200/- of equity and buy Rs 6,900/- and Rs 3,300/- of debt and gold respectively.

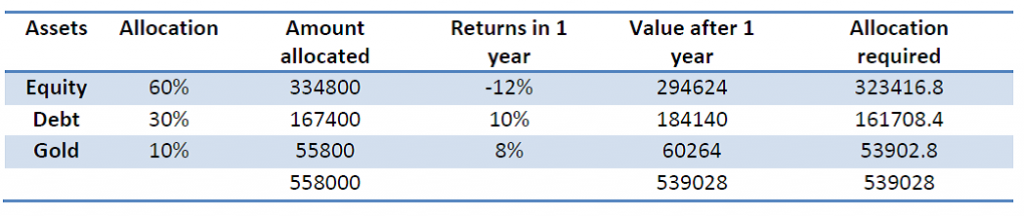

Next Year-

This calls for buying Rs 28,793/- of equity and selling of Rs 22,432/- and Rs 6,361/- of debt and gold respectively.

You have to repeat this process after every particular interval, which may be 1 year or 3 years. This rebalancing process will keep the volatility as per your acceptable risk tolerance and also help you in buying low and selling high.

If this was not the process you follow then you would have bought more of equity in Year 1 under the lure of high returns as the stock market was performing good and next year, you would have lost big money.

Conclusion:

Determining asset allocation is a very important financial decision, more important than selecting the right investment product, as this will have more impact on your overall portfolio return. And be sure to periodically review your portfolio to ensure that your chosen mixes of investments also have diversified among different sectors.

Hope your doubts regarding Asset allocation have been cleared. If you have any question, feel free to ask in the comments section below