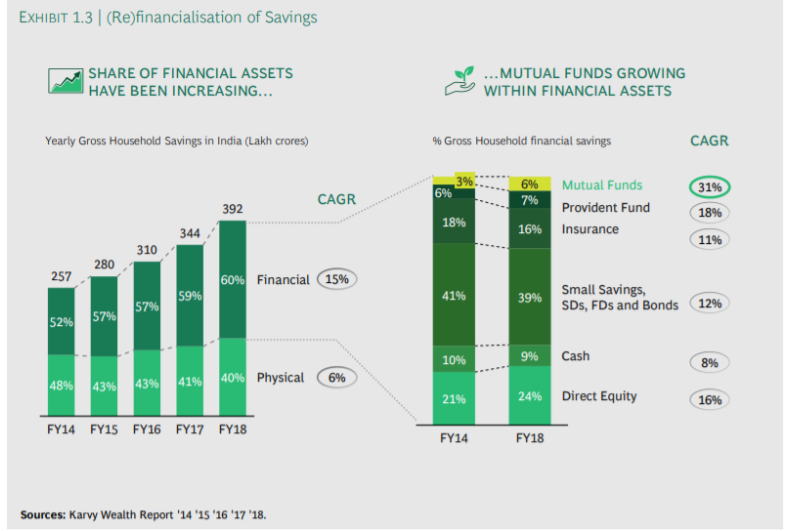

A survey conducted by the Association of Mutual Funds (AMFI) along with the Boston Consulting Group in August 2019, states that- Mutual Funds account for only 6% of the Gross Household Savings, which is nearly 60% of total household assets in India. Although it has increased (nearly doubled) from only a 3% share in 2014. Thanks to the “Mutual Fund Sahi hai” campaign, it has played a major role in increasing the visibility of the product.

Still, the number is significantly lower, when we look at fixed income instruments, such as- Small saving schemes, Fixed Deposits, etc.which account for nearly 40% of the financial savings.

(Also Read: Asset Allocation: the balanced diet to your investment portfolio)

The primary reason being that despite all the efforts, even today, a lot of investors perceive mutual funds a complex investment, which is beyond their understanding.

Well, this is not the case. Let’s try and understand what a mutual fund is and how it works, in layman terms.

What is a Mutual Fund?

It is basically, an investment instrument through which money from different investors gets invested in various asset classes as per the underlying investment objective. The money collected is managed by a Fund Manager, who is responsible to take investment decisions and tries to generate returns out of the same, in exchange of a fee. Investors are allotted units, as per their holding in the fund.

The price per unit value is called Net Asset Value or NAV. As the investment value grows, the NAV also increases and the profit/loss is again distributed to the investors in the proportion of their holdings

All this works in a trust structure and trustees ensure that the Fund Management decisions are taken in the benefit of investors and act as a custodian of the investors’ money.

But before launching any Mutual Fund scheme, it needs to get a nod and be registered with the Securities and Exchange Board of India (SEBI), the securities market regulator.

Mutual Fund: Classification:

Mutual funds are classified based on the following categories:

- Underlying Asset Class

- Nature of Investment

- Availability for subscription or maturity period

1.Types of Mutual funds on the basis of Underlying Asset Class:

- Equity Funds: These are funds that invest in listed stocks of different companies. These are growth-oriented funds, meant for capital appreciation over the long-term horizon, generally suitable for investors having a very high-risk tolerance and are ready to bear short-term volatility in their portfolio.

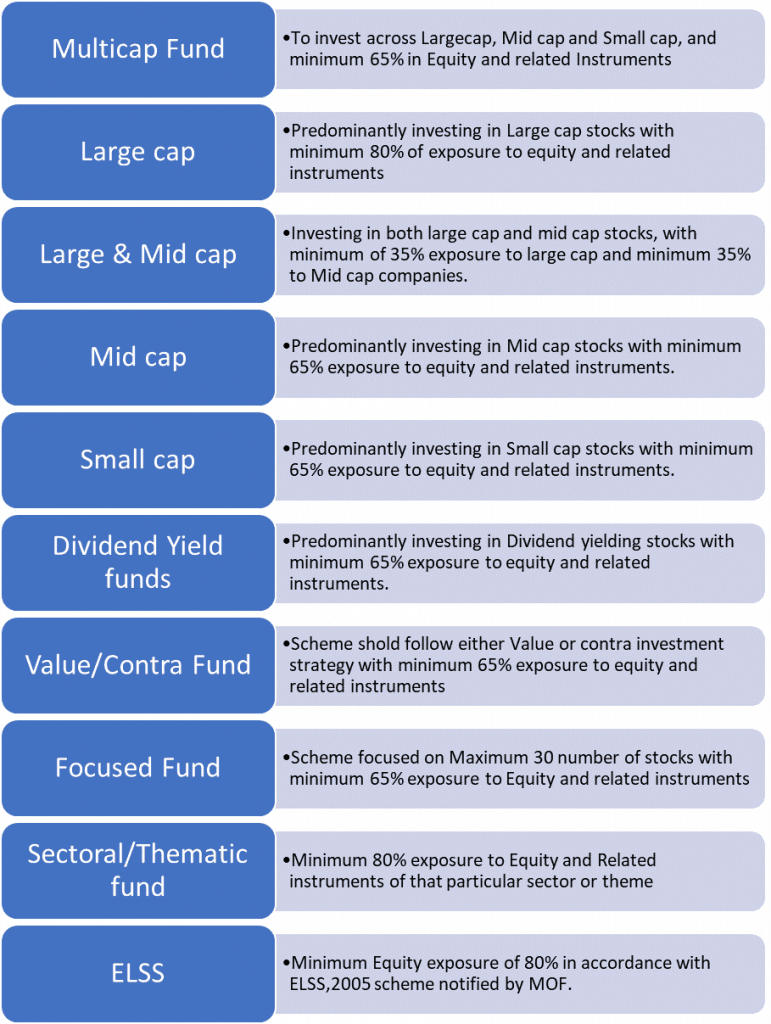

Equity Funds are further classified into the following 10 categories:

- Debt Funds: These funds generally invest in fixed interest-bearing securities, such as- Government Bonds, Corporate Bonds, Money market instruments, etc. These are comparatively low-risk options, meant to provide stability to the long term investment portfolio and may also support short term goals (up to a 3-year horizon).

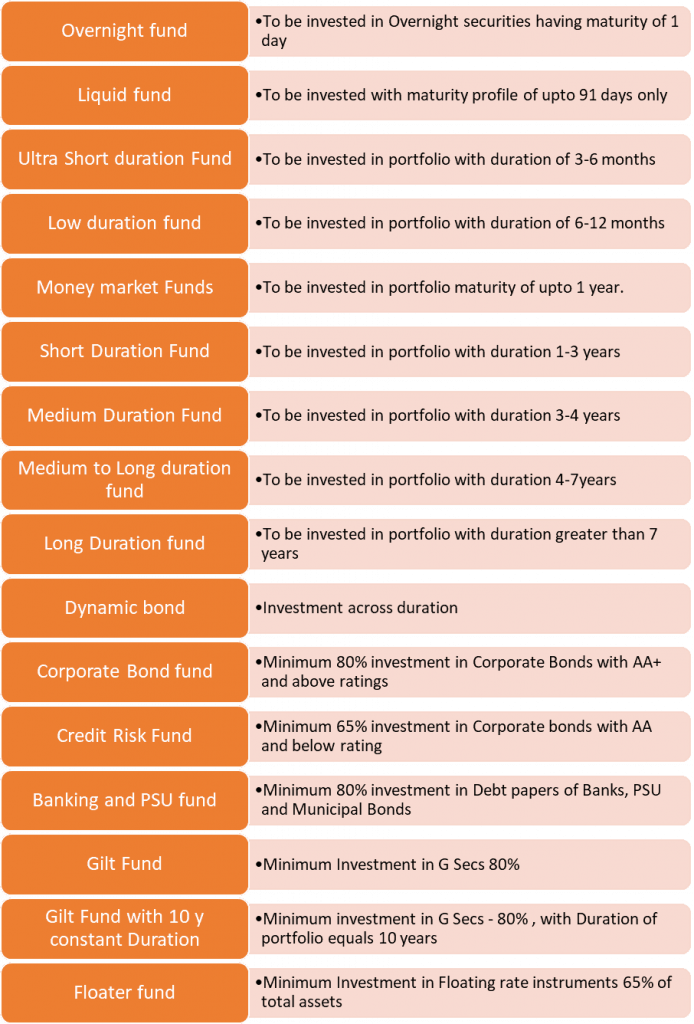

However, some categories of debt funds may have a high degree of risk, such as – credit risk funds and some may be volatile in a short -term due to interest rate fluctuations. Debt funds are further classified into the following 16 categories:

- Hybrid Funds: These funds are a blend of both Equity and Debt i.e. they invest in both stocks and bonds (fixed income securities) as per the structure they fall into. Equity portion may provide the required growth and debt portion provides the required stability over a medium-term horizon (3-5 years), which make them suitable for the investors with a lower risk appetite, who do not want to get into asset allocation or do not have any financial planner by their side.

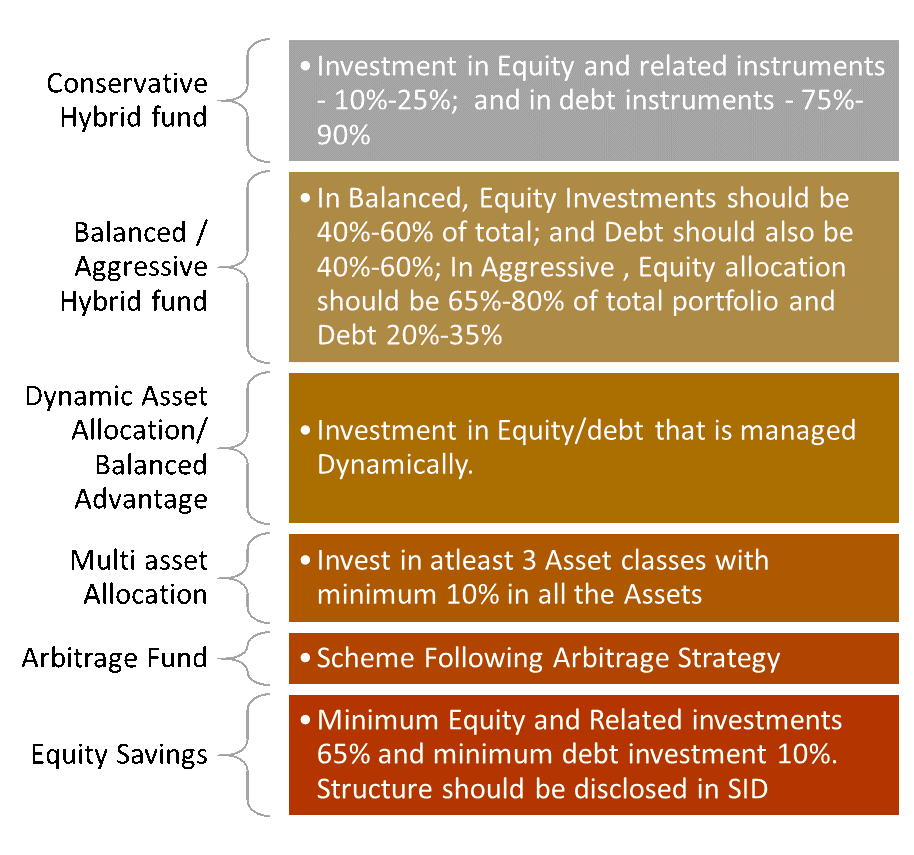

Hybrid funds are further classified into the following 6 categories:

- Solution-oriented funds: These are funds that come with a 5-year lock-in and have some specific condition or purpose attached to it. There are two types of solution-oriented funds available in India- Retirement oriented and Children’s Gift funds.

- Fund-of-Funds: These are funds, which invest in other mutual funds, not necessarily of the same fund house. These funds may invest in funds of other fund houses as well. They do not participate in direct investing in stocks or bonds.

- International Funds: It is a new category of mutual funds, which has gained traction in recent times. These are funds which invest in the securities of Foreign Countries. Depending upon their structure, they may invest in securities of specific countries or sectors or may diversify their investments across different countries or sectors.

- Gold Funds: These are funds which directly or indirectly invest in Gold as an Underlying Asset Class. They provide the investors’ exposure in gold through units of Gold ETFs, which saves them from holding Gold in physical form.

2. Types of Mutual funds on the basis of Nature of Investing :

- Active Funds: These funds are those which are actively managed by the fund manager and try to beat the benchmark returns or the market returns, by taking active investment decisions, within the scope of the category in which the fund falls into. Sometimes, a lot of research is involved in these calls, this is the reason in these funds the fund management fee (Expense ratio) is high.

- Passive or Index Funds: These funds track the Benchmark Index such as- Sensex, Nifty, etc. and try to replicate its composition and holding pattern. Since, these funds tend to generate similar kinds of returns as the index or market return, not much research or analysis is involved in taking the calls, so active management is not required to manage these funds. This is the reason the fund management cost is also comparatively lesser.

The other way to passive investing is through Exchange Traded Funds (ETFs), which are listed on the stock exchange and require a demat account to invest in the same.

3.Types of Mutual funds on the basis of Availability for Subscription or Maturity period :

- Open-ended Funds: These are funds that are available for subscription at any point in time and there is no fixed maturity period as well. Investors can transact any number of times in these funds, as they wish. Investments and withdrawals, whether lump sum or systematic is flexible.

- Close-ended Funds: These funds are having a fixed maturity period (5 years, 7 years), etc. Investors are allowed to subscribe only at the time of the fund launch. In other words, during the New Fund Offer (NFO) period only. However, these funds have to be mandatorily listed on Stock exchanges, where the investors can buy and sell.

- Interval Funds: These funds are a mix of both open and close-ended funds. These funds allow purchases and redemptions at pre-specified intervals at the prevailing NAV price. These can also be traded on stock exchanges.

Hope, the above article throws light on the Concept and Types of Mutual Funds. If you have any questions, feel free to ask in the comments section.

Are mutual funds safe? my friends say recently they have lost a lot of money in mutual fund investments.