If you are a mutual fund investor or planning to be one, then it would be wise to know the taxation of Mutual Funds so you may plan your investments and withdrawals accordingly. Tax rules get reviewed every financial year, so it becomes necessary to remain updated with the latest rules to plan your finances well.

(Also Read: Concept and Types of mutual funds)

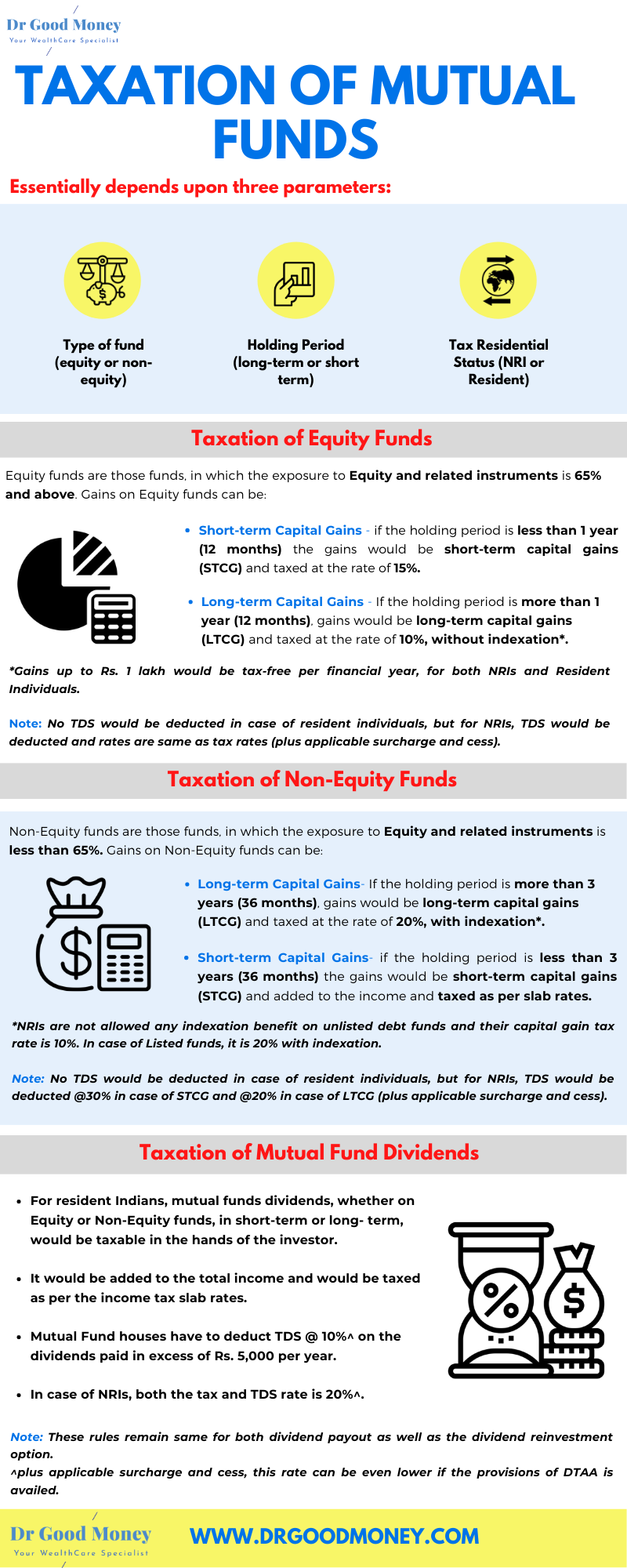

Mutual Fund taxation (Infographics)

I have summarized the provisions of mutual funds taxation in the infographics below. It briefly enlists the tax implications on equity and non-equity mutual funds for both resident Indians and Non-Residents as well. In addition, it also contains the tax provisions on Dividends received from Mutual Funds.

I have tried to cover everything about taxation on Mutual Funds in this infographics, including tax rates, applicable TDS for both short and long-term capital gains.

In the end-

As stated above, tax rules get tweaked every year and may impact your investments too. So, before making any investment decision referring to the tax rules written here, do consult your CA or a Financial Planner. Or ask in the comments section below for verification.

Hope, the infographic clears all your doubts on taxation of mutual funds in India, if you find it useful, do share it with your family, friends, and colleagues.