Dr. Sumit, aged 36, was surprised to see his home loan statement as the interest rates on his loan had skyrocketed. He had taken the home loan in April 2022, when the interest rates were at their lowest, at 7% p.a. for a 20-year tenure. He had plans to repay the loan before he turned 55 by prepaying at regular intervals when he would receive any bonus or his salary would increase.

Unfortunately, due to rising interest rates consistently over the past year, Sumit’s effective interest rate on the home loan has increased to 9.25%, and his loan tenure has been extended by 18 years. As a result, he will have to continue paying his home loan EMI even after he retires, until he turns 74.

Initially, Dr. Sumit assumed there was an error at the bank’s end and reached out to clarify the issue. He then reached out to a financial advisor with this query on how to manage the home loan repayment amidst the rising interest rates and uncertain economic scenario.

Should he prepay the home loan by liquidating some of the low-yielding investments in his portfolio, increase his EMIs or extend the loan tenure?

Sumit’s situation is not unique as many borrowers are affected by rising interest rates, particularly for long-term loans like home loans. And all this is due to the rising inflation worldwide and domestically and thus the RBI action on Repo rates.

The effect of rising repo rate:

The Reserve Bank of India (RBI) has instructed banks to do external benchmarking of the home loan interest rates sanctioned after 1st October 2019. The repo rate is the most common external benchmark used by banks to link home loan rates. When the RBI changes the repo rate in its Monetary Policy, it affects home loan interest rates. If repo rates increase, home loan interest rates also rise, and vice versa.

FREE Download

YOUR FINANCIAL DATA

RECORD KEEPER

Organize and Collate data at a Single Place for easy Access and Management

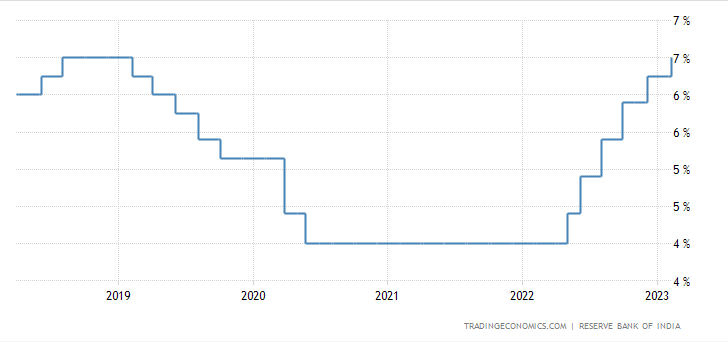

From 2019, the RBI consistently decreased the repo rate until May 2022, leading to a decline in home loan interest rates, which actually brought Interest rates to mouth watering levels. But later, Post Russia Ukraine crisis, the RBI has since increased the repo rate to contain inflationary pressure in the economy.

As of March 2023, the repo rate has increased by nearly 250 basis points, reaching around 6.50% from its 2020 low of 4%.

In the graph below, you can see how the repo rate has changed between 2019 and March 2023:

As a result, banks have passed the rising repo rate on to home loan borrowers, resulting in interest rates above 9%. In the case of NBFCs, rates are in Double Digits

Increasing EMIs or extending loan tenure: What to choose?

In the event of a rise in interest rates, borrowers have two options: increase the loan tenure or increase the EMI. Typically, banks tend to extend the tenure of home loans, keeping the EMI constant as long as it covers the interest component. However, if the EMI falls short of covering the interest, the bank may increase the loan EMI.

This practice has led to shock for borrowers like Dr. Sumit, who took out loans from 2019 to early 2022, as their 15-20 year loan tenure has been extended to 50 years or more in some cases.

However, borrowers have the choice of increasing the loan installment to keep the loan tenure unchanged. But, which option is better?

In Sumit’s case, we ran some calculations and found that if he increases the EMI in line with the interest rate and maintains the loan tenure at 20 years, he will pay a total interest of Rs. 58.50 Lakhs on a Rs. 50 Lakh loan. Conversely, if he chooses to increase the loan tenure and keep the EMI the same as before, the total interest on his loan will soar to Rs. 1.32 crores.

Thus, it is evident from the analysis that increasing the loan tenure will result in a significantly higher interest outflow over the loan term than increasing the EMI. Therefore, it is better to opt for an increase in the EMI rather than extending the loan tenure.

Other options to manage the increasing home loan burden:

One way to manage your home loan repayments during a rising interest rate scenario is by increasing your EMI rather than extending the loan tenure. This strategy can reduce your interest outgo, especially in the initial years when the interest component is higher than the principal repaid. ( Also read: How doctors should plan their first Home purchase)

Other options include partial prepayment of the loan at regular intervals, paying additional EMIs, and increasing the EMI by a fixed percentage in line with your income increment. Prepaying a portion of the loan in the initial tenure of 5-10 years can help you complete the loan before the term and save on interest.

For instance, by prepaying 5% of the loan principal every year, you can complete your 20-year home loan in just 11 years. Similarly, increasing the EMI by 5% every year can reduce the loan tenure by 5 years.

If your loan interest rate is high (around 10% or more), you can consider prepaying the loan by liquidating your debt investments/Low yielding Insurance policies in the portfolio. However, the recent changes in tax laws have impacted debt mutual funds’ tax efficiency, so evaluate the options as redemption may result in losing the long-term indexation benefit of old investments.

If these options are not suitable, you can negotiate the interest rate with your existing lender or opt for a home loan balance transfer to another bank offering a lower interest rate. As a doctor, managing your finances is essential, and having a strategy in place to manage your home loan repayment can help you achieve your financial goals.

Decide based on the Bigger Picture

When interest rates rise due to high inflation, it’s essential to make informed decisions about your personal finances. Just focusing on interest savings might not be enough; it’s crucial to look at your overall financial profile before deciding to increase your EMI, extend your loan tenure or opt for prepayment of the loan.

While prepaying the loan can be beneficial, it’s crucial to consider its impact on your cash flows, other high-interest loans, and financial goals. Ensure that you have an adequate emergency fund, health and term life insurance cover in place, and that your financial strategy aligns with both your short and long-term goals, including prioritizing retirement and children’s education.

In summary, it’s best to prepare a financial plan that considers all possible scenarios and then decide which repayment option would be best for managing your home loan repayments in a rising interest rate environment.

Before prepaying your home loan, take into account the processing fees, other charges, and terms and conditions associated with prepayment, negotiation, and balance transfer of the loan. By doing so, you can make an informed decision that aligns with your financial goals and situation.

In the end…

Having a sound financial plan is essential when it comes to managing your home loan repayments in the long run. With the increasing interest rates, it is more important than ever to consider all the options available before deciding on whether to increase the EMI, extend the tenure, or prepay the loan.

It is vital to assess the impacts of each option on your overall financial profile and goals, and not to make a decision in isolation. Without a solid financial plan, it can adversely affect your cash flows and hinder your short and long-term financial goals.

If you find it challenging to manage your finances, it is highly recommended to seek the advice of a professional financial planner with expertise in debt management and overall financial planning.