As the careers and lives of Doctors progress very differently from others, why should their financial planning be the same as the general public?

When you go online, you might find various financial planning articles that are very generic in nature. Probably, the intent behind this would be to reach the largest possible audience.

But for niche audiences – like Doctors, and other professionals, some specific advice may differ.

For example, in the case of other professionals, one could start earning when they complete graduation or post-graduation in their early 20s. But doctors may not find a stable job until their late 20s or even early 30s.

Professional/Career Life Stages of a Doctor:

As per our discussion with many doctors – clients and friends both – we can generalize the life stages of a doctor roughly like the following:

- They study till their late 20s, sometimes early 30s.

- Get their first paying job in residency after that – half a decade later than most others.

- By their late 20s or early 30s, they get married as they start settling down professionally.

- Start to make a mark in the 40s and go for advanced degrees and diplomas – further out-of-pocket expenses.

- Establish their private practice in the mid/late 40s – a clinic, nursing home, or a small hospital with considerable financial outlay.

- They may continue to work as a tenured Doctor at a hospital or work as visiting consultants at multiple hospitals.

- Grow the private establishment till their 60s.

- May retire from a formal job any time after 60 but may continue as consultants while practicing at their own hospital.

- Can continue to work till their 70s or even 80s with a gradual transition to administrative and advisory roles.

- Keep Attending various Domestic and International Conferences, to upgrade and update self, which further increase the overall expenses.

Financial Life Stages of Doctors:

As is apparent from the above list, the doctors continue to study and spend enormous amounts on their education and private practice till late in their life. These are all valid financial goals for them along with the usual ones like their own wedding, children, their higher education, home, children’s marriages, and retirement. (Also Read: How young doctors should set their financial goals?)

But as their incomes start late, they must make it up for the lost time.

One thing that goes in favor of doctors is that once you have years of experience, you can support your salary with a lucrative additional income with private practice and consultancy. So even if you may start late, you can more than makeup for the lost time.

Late Teens to 25 Years: Early Education – MBBS & BDS

The medical education world over is expensive, if not subsidized by the government. The same is true for India. Therefore, if you cannot get into a government college, then the cost of medical education is another big financial commitment you are looking at. This requires substantial financial input from the parents as no bank would grant a loan to a student for such a large amount.

As far as financial planning is concerned, not much can be done on your part to earn and invest. Your sole focus must be only on excelling in your academics.

However, during this time you can inculcate some life-long financial habits, that will put you in good stead later:

- Start keeping track of your expenses in a pocket diary or an app. Be brutally truthful in maintaining the expenditure record.

- You can also start saving from your pocket money and the occasional cash gifts from relatives.

- If you don’t have a bank account, open one, and start a recurring deposit. Start learning the ropes while the amount at stake is very small. You will make mistakes, but they will not be costly at this stage.

- As the budget of your parents is already stretched due to the expensive coaching and now education, you must realize that you cannot have everything. So, you must start prioritizing – make a budget and mark different items as “Essential”, “Maybe”, and “Optional”.

- Take some time to learn about multiple income sources, other things would follow naturally.

- If your schedule permits, start a gig work – content writing, tutoring, or assisting at some private clinic. The experience to collaborate with people would help you later in life.

(Also Read: Financial Planning Tips for Young Doctors)

25 to Early 30s years: Residency and Masters

Once the MBBS is over, a doctor may not get a high-paying job like Engineering or Management graduate from a prestigious institute. There are no placements, campus drives, or even pooled placements drives. The doctors’ real professional journey begins at this stage.

While they are working as junior residents, they prepare for the PG entrance test. As compared to UG seats, there are a lot fewer PG seats, and some of the residents continue to work as residents for 2-3 years. Even during their PG (MS, MD, or MDS in chosen specialization) the stipend paid barely covers their cost of living and studying.

Once again, the parents of medical students must come to their rescue as the cost of PG is also expensive, if not done from a government medical college. This is also the time, you can contribute, however little it is, by saving from your stipend.

As you embark on your professional journey, you will start earning a stipend – which is not much. But you should understand that it is not nothing, either. As your income is low, most of it would go to sustain yourself.

Many doctors also find their life partners in this period. Many doctors find their life partners among their colleagues or long-time fellow students, who understand the pressure of the profession very well.

Some also take the leap and tie the knot. It is not that such a decision is right or wrong. But you must fully understand that along with many joys, marriage also brings a new set of responsibilities with it. Living together can cut down on many expenses, and make some things easier for you to manage. While some other things and a little more complicated.

There are a few things where you can start your investment journey. If you are already married, then never forget to share your investment philosophy, goals, and plans with your spouse. Being open and involving your spouse is the first step towards wellness in your personal and financial life!

Before we go further, let’s see what can be the big financial commitments in this stage of life:

- Pay for the expenses of the PG and super-specialization.

- Saving for marriage, vacations, and family responsibilities.

- Maintaining a healthy lifestyle, work-life balance, and not getting bogged down by financial worries.

The steps below build upon the good financial practices that you started following in your teens and would help you come nearer to meeting all these commitments, a little daily.

1. Keep a Check on Expenses and Debt

As you are already keeping a track of your expenses – in a diary or an app – it is easy for you to manage cash inflows and outflows.

You must at all costs try not to get into the debt trap. Follow a simple rule – all debt is bad. The only justifiable expenses on credit can be for your studies (education loan) or for an emergency.

Though it may sound tempting, it is not the right time to get into the debt trap of credit cards, car loans, and personal loans. You must prioritize your spending and plan.

2. Before Investing, Secure Yourself

If you can save a decent amount and have a good bank balance, then do not treat it as your disposable income or investible surplus. Being a doctor, you must realize two things:

- Anything could happen to anyone.

- The biggest reason for most Indian middle-class households in becoming poor is expensive medical bills.

Though you are a doctor and may feel that you do not need any health insurance. But if you are caught off guard, then even you might have to shell out too much on expensive medicines and treatments.

As you share responsibilities at home, you must create a safety net around yourself and your family. This net will make you robust and give you endurance in turbulent times.

Your safety net, ideally, should consist of a decent bank balance to cover your expenses for a few months, health insurance, and term life insurance (if you have financial dependents). (Also Read: Do housewives also need term life insurance?)

Meanwhile, many of you start your families. Marriage and then kids add too much to your responsibility, making the safety net even more necessary.

3. Don’t Just Save, Invest

Continuing your investment journey of depositing a hundred rupees in an RD, you can start making some substantial investments. As you are young and have a promising career ahead, you can take more risks than someone in their 50s.

Once you have decided to invest, you can search for and invest in growth-oriented securities – equity mutual funds, direct equities, and even REITs and InvITs. (Also Read: New Age Investment options for Doctors)

You should focus on these rules:

- Preservation of capital.

- Reasonable growth.

- Post-inflation, and post-tax real positive returns.

Goal-based financial planning is one of the best ways you can earmark your investments to reach specific milestones.

The idea of going to a financial planner may seem ludicrous and expensive. But you would rather see a specialist in case of an emergency, or would you rather self-medicate? As doctors, perhaps you understand the importance of delegating the complicated work to a specialist far better than any other professional.

(Also Read: Best investment options for Doctors- All-weather investment portfolio)

The 30s : Of Jobs, Marriages, and Life

Once the PG in medicine or surgery is complete, with enough residency experience, doctors can start their careers at a hospital. As they gain experience, they continue to study for higher education and super specialization.

This is the time, by which most doctors have also settled in their personal lives, i.e., have married and probably have had a kid. This means there are more responsibilities and financial commitments.

Let’s look at a few of them:

- Some professional goals for you and your spouse (most likely a doctor) could be:

- Preparing for the super specialization.

- Providing for the kids’ education and welfare.

- Providing for your plans of establishing a private clinic or hospital.

- Paying for attending conferences and training nationally and internationally to gain exposure and build a network.

- Some of your personal goals could be:

- Family goals.

- Paying-off education loan, if any.

- Child planning.

- Retirement planning.

- Buying your own home.

- Buying a car.

- Family Vacation, at least once a year.

(Also Read: Why Retirement Planning should be the most important goal for doctors?)

Credit/Loans can be Good, Bad, or Worse

To meet some of the goals, like many other professionals, doctors might also take a personal/car/home loan and pay for something that could be out of the reach of their incomes. There is nothing wrong with taking credit, but it should be responsible.

Expensive loans that are beyond your means, taken for the purpose of consumption or for buying depreciating assets like- revolving credit card loans, personal loans for marriage, vacations, and auto loans for big SUVs or luxury cars, are considered the worst loans and you should avoid them at any cost.

Not only these loans would ruin your financial behaviour but would adversely impact your credit score as well.

Loans taken for the purchase of cars or white goods come in the bad category of loans because as soon as these goods leave the showroom, their value starts depreciating.

Loans taken for productive purposes like- loans taken for educational purposes, to expand the practice, or to acquire appreciating assets like- a home loan are considered good loans.

However, the loan should only be taken if you are financially stable – which depends on your perspective and requirements. You should never compromise your personal financial wellness, just like you won’t compromise your physical wellness.

Our simple advice, if you cannot afford to pay for them in cash up-front, then do not buy them on a loan either. It is in these situations, that a personal financial advisor can be of immense help – they save you from falling into the trap. And if you are already in it, then they can advise on how to get out of it.

(Read: How Doctors should plan for, before taking any loan?)

Investments: Do Not Fall for Mis-selling, Neither Mis-buy

Often financial blogs and ‘experts’ on TV rant about the rampant practice of mis-selling financial products. They cry out loud to alert the regulators and investors to beware of these ‘toxic’ products which may harm their financial interests. The funny thing is, that the definition and the list of such toxic products also change from one expert to another.

Mis-selling of financial products happens every now and then. Brokers and relationship managers find too many ingenious ways to circumvent the regulations and dupe investors. And there is no other way but to control your emotions of greed & fear and be aware of what you are signing the cheque for.

But we wish to highlight one more aspect of bad investing – mis-buying. Yes, that happens too. As the name suggests, investors ask for the wrong product to be sold to them, and doctors are no different.

If you insist on investing in a security that gives “high returns with low risks and least volatility” then you are asking for the moon. There is no such financial product that can always give you all three of them – probably not even any of the times.

So, if you are insistent, then your RM has no other choice but to ‘chipkao’ you (stick you with) a ULIP or a traditional insurance plan. These plans are neither good from an insurance purpose nor from an investment perspective.

If your greed is too high, then they may even sell you exotic products and make you trade in derivatives – “Weapons of Mass Destruction” according to Warrant Buffett.

In effect, you are getting what you asked for.

(Also Read: Situations when Doctors behave like their patients)

Late 30s or early 40s and Beyond: Super Specialization & Private Practice

To progress in their career – at their jobs as well as in their practice – doctors need to become super-specialists. As they secure their DM or MCh degrees, as well as advanced diplomas and certificates, already 5 to 8 years of their work-life have passed.

They are now in their mid-to-late-40s, and with a glowing resume, they can command good salaries in private sector jobs. By this time, most doctors start their private practice on the side, adding to their incomes. Being married to another doctor helps them in expanding their private practice with scale. (Also Read: Financial Planning Tips for Practicing Doctors)

At this juncture, some of the personal and professional financial commitments include:

- Higher education of kids.

- Marriage of kids.

- Buying a home.

- Learning new techniques and earning advanced diplomas.

- Establishing and expanding the private practice.

- Taking care of aging parents.

- Retirement planning for self.

As the financial commitments of doctors grow exponentially, they can get into a frenzy to meet them. And as they say, haste makes waste.

Whatever the case, a financial plan is a well-thought-out strategic document that requires careful execution, monitoring, and control over a long time. Having a financial advisor can help your meet these goals.

Invest More to Grow More

Though, goal-based investing will bring you some structure, in the end all investing will come down to the fact of the sufficiency of funds to meet those goals.

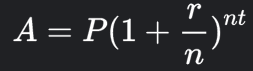

For most people in the formula for compounding, the variable that they can control is time (n) as the rate of return (r) is assumed to be something reasonable and the principal (P) is small, to begin with.

The fact that at this stage, as you have earned a reputation, your income also rises faster than most other professionals. This helps immensely to make up for the lost time by investing a bigger chunk each month than your peers.

With a larger contribution to the principal (P), you still can have a sufficiently large corpus (A) in the end, even if you start a little late.

You Cannot be Imprudent

With so much at stake, larger investments, and a shorter window to grow it, you cannot be imprudent, greedy, and fearful. Rationality has to take precedence over everything else.

For example, if most of your large-ticket goals are far (7+ years) away, then the fall in the stock market should not worry you. In fact, you must welcome this type of correction to invest more in equity-linked funds and securities with sound fundamentals to give your investments a fillip.

However, prudence also requires you to hedge against such a scenario playing out for a long term till your goals become imminent. Or such a correction happening just around the corner, when you were about to redeem your investments.

Tracking all these variables is too much of a headache and requires full-time attention to detail. This is where a financial planner comes into the picture. They will manage your portfolio with a 360-degree view and will keep all scenarios in mind before settling on an asset allocation.

Financial Planning for Doctors

As we can see that the life journey for doctors is different from a typical person’s, we cannot bracket them into the same category as others like others, when it comes to financial planning.

As we have seen many doctors are interested in establishing their small but niche practice, some are institution builders who can mobilize resources to build a grand hospital, while some are interested in carrying out more charitable work at a nominal fee.

To fulfill any of these dreams, as well as the usual life goals of children’s education & marriage, and retirement, they need customized financial plans. (Also Read: Financial Planning for Doctors- What to expect?)

Although the basic thumb rules remain the same, advice in specific situations on various aspects like- cash flow management, tax planning, debt management, retirement planning, etc. might differ for doctors.

In some situations, an in-detail diagnosis might be required if you are already burdened with various financial products like- loans, insurance policies, investments, etc. This would help you keep only the suitable ones and come out of the non-suitable ones.

So, it is imperative for doctors to visit their financial advisor to discuss financial goals, roadblocks, and prudent ways to overcome them. A fee-only financial planner and SEBI Registered Investment Advisor would be the ideal choice. (Read: How Doctors should choose their financial advisor in India?)