Many doctors ask me to advise on safe and high-interest paying products. Though this question may lead them to buy some non-suitable instruments, as safety can’t be highly paying, this is for sure.

But yes, that lead me to discuss with them on Non-Convertible Debentures (NCDs), which could answer their requirement, only if they understand the inherent risks.

This article is about my explanation to them on this subject.

A company needs capital for multiple reasons. It could be for:

- Capacity/geographic expansion.

- Procurement of new technology, equipment, or land.

- Upgrade and maintenance of existing machinery.

- Lending to others.

- Acquiring another company.

To fund these, the company may need to raise a large amount of capital. A corporate has multiple avenues to raise funds:

- Issue of fresh equity shares.

- Long-term loans from domestic banks or financial institutions.

- Borrowing from abroad.

- Issuing debt instruments such as debentures.

Among the above options, equity shares and debentures are the only two options by which retail investors can participate in the growth story of a company.

There are already too many articles on the whys and the hows of equity investing. Let us understand how retail investors can use the debenture route to invest.

Debentures and Their Types

Debentures are long-term debt instruments that may or may not be backed by any collateral. Since Debentures are the securities issued to borrow, so the reputation and creditworthiness of the company issuing them, matters a lot, along with their Financial Standing

When you invest in a debenture, you are essentially lending money to a company. In return, the company promises to pay you back interest at a fixed rate along with the principal amount on maturity.

Debentures can be classified basis their convertibility and the underlying security.

Difference between Convertible and Non-Convertible Debentures

Debentures can be classified as convertible and non-convertible. The company must specify at the time of the issue whether they are convertible.

Convertible Debentures

The holders of convertible debentures have the option to get them converted into equity shares of the issuing company, after a minimum holding period. These are unsecured with no collateral backing. The minimum holding period can be equal to or less than the maturity period of the debentures.

Convertible debentures provide the benefits of fixed interest payment to the investors with the option to convert into equity and reap the benefits from the growth of the company.

Further, convertible debentures can be categorized as fully convertible debentures (FCDs) or partially convertible debentures (PCDs).

- FCDs allow the investors to convert the entire face value of the debentures into equity shares of the company.

- PCDs give allow only a part of the face value of the debenture to be converted into equity shares of the company. The balance is paid out on maturity.

Non-convertible Debentures

Non-convertible debentures (NCDs) come with no feature of conversion into Equity. NCDs always remain a debt instrument and are redeemed on maturity.

Difference between Secured and Non-Secured Debentures

Secured Debentures

Secured Non Convertible debentures are backed by some underlying asset. Secured debentures are considered safer as the debenture holders have a priority among all debentures to pay Interest and principal, at the time of winding up of the company.

Though not easily and directly liquidated, but the respective assets are considered for this payment and as and when liquidation process completes, NCD holders are expected to get their money back.

Unsecured Debentures

An unsecured debenture offers no such safety. The debenture holder’s claims on the company’s assets are inferior to the claims of other secured creditors. Unsecured debentures involve very high risks but also offer higher interest rates.

With a fixed and higher interest income, it may sound like a lucrative investment option. Additionally, Listed NCDs are also more tax-efficient compared to bank fixed deposits of the same maturity.

Why Non-Convertible Debentures?

- In the current low-interest scenario, Non-Convertible Debentures are the most lucrative fixed-income instrument for retail investors. Doctors who seek safe investment may explore this product post allocating money in small saving instruments.

- Non-Convertible Debentures offer an even better source of income for those in the lower tax slabs.

- Depending on the issue terms, the interest paid out can be monthly, quarterly, or annually, giving you the necessary cash flow for routine expenses.

- The maturity period is between two to ten years. As they are traded on stock exchanges, so liquidity may be easily manageable. You can easily align their maturity with your goals.

- NCDs are liquid and there is no interest penalty on selling them before maturity.

- NCDs offer an option to diversify investments.

Also Check- Best Investment Options for Doctors

How to buy Non-Convertible Debentures?

Just like equity shares, you can either subscribe to an NCD issue or buy them from the secondary market. The formalities for subscribing to an NCD issue are the same as an equity IPO.

You need a Demat account with a broker to subscribe/buy an NCD. The only difference is that the issue for NCD remains open for a longer period compared to an IPO. You may be required a Bond dealer’s help to buy the bonds from the secondary market.

Unlike stock, where the promoters can fix any issue price band, Non-Convertible Debentures are always issued with a face value of Rs. 1,000. The minimum tranche for retail investors in a new issue is 10 NCDs or Rs. 10,000. However, secondary market prices depend on the Interest rate situation, plus the demand and supply of papers.

Are Non-Convertible Debentures safe?

The higher interest rates on Non-Convertible Debentures in India are their biggest selling proposition but they must not be the only deciding factor for an investor. Often, cash-strapped companies bring their NCD issue with higher interest rates to entice the gullible public. Therefore, investments in Unsecured Non-Convertible Debentures are considered undoubtedly riskier and should be made with prudence. (Also Read: Risk Profiling- the Blood Pressure Check before making investments)

Here is the quick checklist for retail investors for NCD investments. For do it yourself investor doctor, you may follow these or may like to engage with a Fee-only Financial Planner, to help you guide and invest in such suitable instruments

Company’s History

Before investing in the NCD of a company, it is important to go through the company’s past track record of successfully raising and servicing long-term debt – from banks, FIs, or the public. It is advisable to invest in NCDs issued only by a high-quality company with a sound track record with no defaults in the past. You may get lower interest rates, but the risk of losing your principal is also comparatively lower.

Company’s Credit Rating

A credit rating is a measurement of a business entity’s ability to service its financial obligations based on past repayment history and current & projected incomes. Usually expressed as a credit score, banks and lenders use a credit rating as one of the factors to determine whether to lend money.

Credit rating agencies issue credit ratings after considering several factors:

- Issuer’s financial statements

- Level and type of debt

- Lending and borrowing history

- Ability to service and repay the debt

- Past debts of the entity

A higher credit rating means that the credit risk – that the company will not pay the interest or principal – is lower. A company’s higher credit rating gives them the room to raise funds at attractive interest rates.

Capital Adequacy Ratio

The CAR, also known as the Capital to Risk Assets Ratio, is the ratio of a lender’s shareholder’s capital to its risk-weighted assets and current liabilities. It reflects whether the company has the necessary funds to survive a potential rough patch. A higher CAR means that the creditors have a larger cushion.

NPA Provisioning

If the company is involved in the business of lending, then their non-performing assets (NPAs) are a cause for concern for their lenders. A higher NPA provisioning means that the company was either imprudent in risk assessment at the time of granting of loans or is callous in their recovery. Either way, as the loans turn non-performing, it is the equity shareholders and the unsecured lenders (NCD holders) that are hit the hardest.

Offer Terms

The DRHP for the NCD issue states specific causes for which the company is raising funds. A careful reading of the terms and conditions will help you ascertain if the capital allocation plans of the company are viable.

Similarly, the terms also specify the interest rate, pay-out frequency, underlying security, and terms for maturity. If these do not align with your financial planning or specific goals, then do not invest.

Diversification

Do not put all eggs into one basket. This is applicable across asset classes, sectors, and companies.

We have seen that some investors with most of their debt allocation invested in company NCDs. Some go to the extreme of holding NCDs of only one company. Diversification can significantly reduce the risks arising out of over concentration.

(Also Read: Asset Allocation- the Balanced Diet to your investment portfolio)

Income Tax on Non-Convertible Debentures:

All new issues of the Non-Convertible Debentures are now in Demat form. and there is no TDS on interest as well as the principal payout.

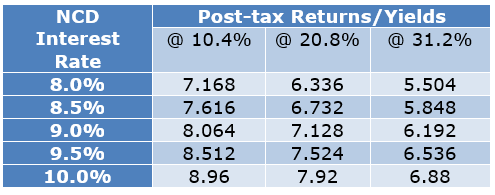

The interest from NCDs is taxed according to your tax slab. This makes NCDs lucrative enough for investors and seniors in the 10% and 20% tax brackets. The table below shows that even at an 8% rate and the highest tax bracket, the post-tax NCD returns are better than a 5-year bank FD (at least for investors under 60).

If you sell them within one year (in the secondary market, on the stock exchange), tax on short-term capital gains (STCG) is applicable according to your slab. If you sell NCDs after one-year, long-term capital gains (LTCG) tax is applicable at 10% (without indexation).

(Also Read: All about Taxation on Mutual Funds)

A higher education cess at 4% is applicable to the total tax liability.

Conclusion

Doctors do not have time to explore or get deep into any investment instrument. Whatever they buy should suit their long and short-term need and also be suitable as per their asset allocation. Higher interest rates of NCDs may seem very tempting, but it also means greater risks. Simply chasing high-interest rates will put your capital in jeopardy.

Non-Convertible Debentures are issued by the companies as a simple and easy way to raise funds. Like any investment vehicle, they have their pros and cons, and retail investors must conduct their due diligence before investing.

Mutual funds are the best way to take exposure to debt instruments, so manage the liquidity as well as the interest rate risk.