A New Income Tax Regime was announced by the Finance Minister in Budget 2020 w.e.f Financial Year 2020-21. So, if you are fine foregoing all the available Income tax exemptions and deductions, then you may opt for this and pay tax with simple calculations.

However, it is not mandatory. One may go with the old regime, and pay taxes as per the old Income tax slabs. Which one would be beneficial depends on what exemptions and deductions you claim and then do a comparison to find which regime would suit your income profile.

You have to choose the eligible benefits from the income tax deductions list 2020-21 and apply on this year’s income to see if the Old regime is beneficial or it’s better to go with the new regime.

Individual doctors and even HUF are eligible to choose between these two.

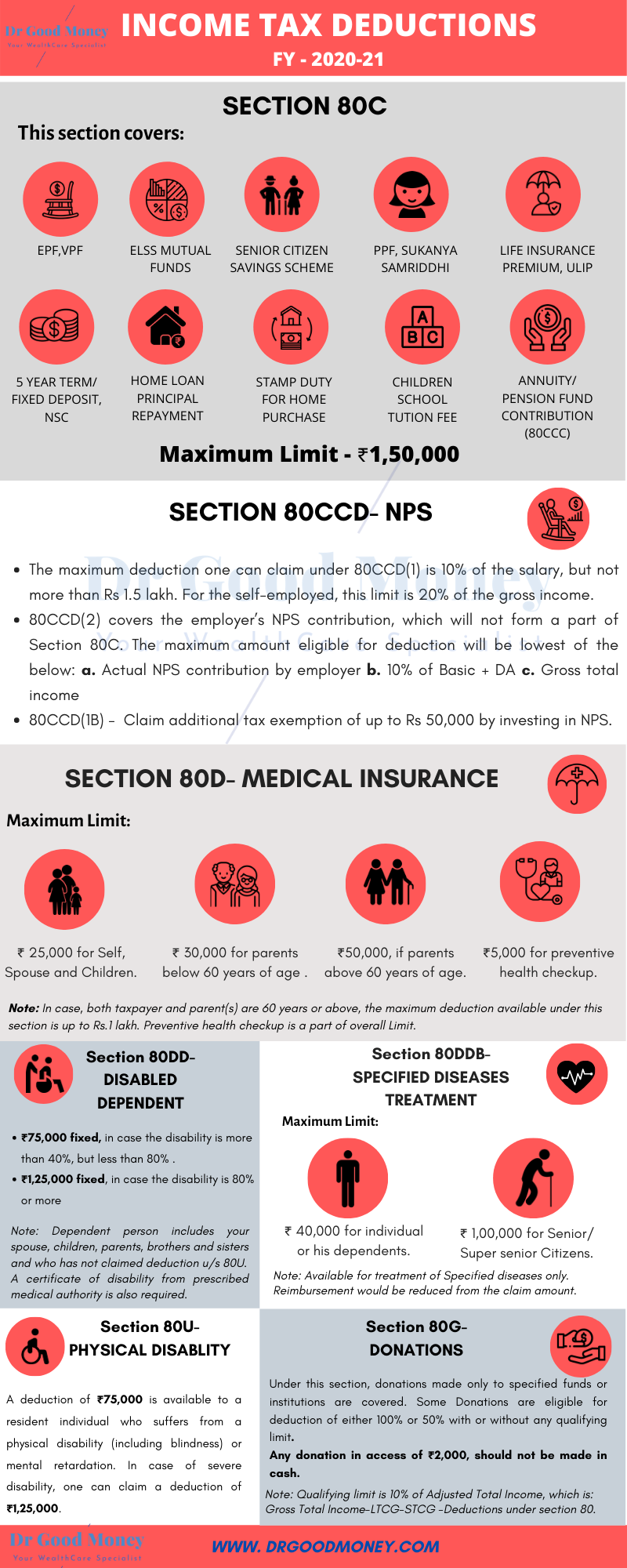

In this post, I have prepared an infographic to summarize some of the available tax deductions that one may be eligible for and make use of to calculate one’s tax liability.

FREE Download

YOUR FINANCIAL DATA

RECORD KEEPER

Organize and Collate data at a Single Place for easy Access and Management

However, to have a detailed understanding on some of the specific sections mentioned in the infographic, I have added some hyperlinks to some of my other articles in this blog, you may refer to them by clicking on the term.

There are multiple options you can use while doing Income Tax Savings u/s 80C, you may see the list of qualifying investments here. Yes, It’s not only about your Income sometimes your expenses also let you save on taxes.

Health Insurance is one of the desirable benefits and most sought after these days. As I always say, depending on the employer-provided cover may not be wise, so better to have your own separate health cover for yourself and your family. The premiums you pay comes under section 80D.

You may make some additional tax savings over and above 80C and 80D, by investing in NPS which comes u/s 80CCD. It’s a wonderful product which one may use for Retirement Planning. Read a detailed post on NPS with infographics

Income Tax Deductions List 2020-21: Infographics

Salaried or Pensioners are eligible for Standard deduction, which is a fixed amount to be deducted from total income.

If you have a Residential let out property given on Rent, then also you may claim Standard deduction while calculating Income from House property.

If you are not earning but paying rent, and are getting HRA (House Rent Allowance) as part of your salary then you are eligible for some tax relief. You may check how the HRA component in your salary slip helps you save on Income tax.

But if you live in a Rented accommodation and are not getting HRA benefit in salary, then you may claim some tax benefit u/s 80GG

The Housing Loan Repayments also relieves you from some tax liability as the Interest portion of the EMI payment is eligible for tax relief u/s 24B, and even the interest of your Education loan comes under section 80E.

Whatever you do, please ensure your Tax Planning should be part of your overall Financial Planning and should support your goals.

Conclusion:

It is very much visible that there are multiple provisions in tax laws that one may take advantage of while doing the tax planning and save taxes wisely. Some of the provisions applicable to you can be gauged from this Income Tax Deductions list 20-21, for others (if any) you should better consult some tax expert to help you do your tax planning in a better way.