The Union budget is not about personal finances only and the proposals are announced keeping the overall country’s growth and prosperity in mind.

It’s the implementation of the proposals where the whole impact is lying, as in if the proposals are good, were they implemented well and if yes, how fast will that show the results?

And all announcements on the expenditure side will be towards the Long term projects, and you don’t see the immediate impact of the same. But you remain confident in the long term growth of the country, and if all goes well as planned then you feel the growth happening too.

This Time Central Government, announced Budget Speech with the Below priorities

And announced List of measures like

- Capital Outlay of Rs 2.40 lakh crore to Indian railways,

- Allocation of Rs 79000 cr towards Pradhan mantri Awas Yojna,

- An Agriculture accelerator fund will be set up to encourage agri startups,

- to encourage the increase of production of mobile phones in India Relief in costumes duty on import of certain parts,

- Many programmes for green fuel, green energy, green farming, green mobility, green buildings, green equipments and policies for efficient use of energy across various economic sectors with the aim of net zero carbon emission by 2070…and many more

The Purpose of this article is to apprise you with the Proposals announced towards the Personal Finance side, which has immediate impact on us, as taxpayers.

Here are the 12 Important Proposals announced impacting the Personal finance

- Changes in the Tax slabs in the New Tax Regime, plus incentives to encourage people to file taxes in this

Also it is proposed to extend the benefit of Standard Deduction which is available to Salaried and Pensioners only in the old tax regime to this New Regime slabs

It is very much clear that the government wants taxpayers to opt for the new regime and are doing their best to make it more attractive for them.

And thus has announced the New Tax regime as the Default Regime for AY 2024-25, with an option to opt for the old scheme if Assessee wants. This means that for Salaried people, if they like their taxes to be calculated on the basis of the old tax regime, they specifically have to inform the HR & Accounts team.

To make this New regime attractive for high Income earners like Rs 5 crore and above, in Budget 2023 it was proposed to reduce the Surcharge applicable from 37% to 25%. However, this benefit is not applicable to the Old Regime calculation, where you are allowed to claim all other deductions u/s 80C – 80U.

Also, for Income bracket not exceeding Rs 7 lakh, Rebate of 100% of Income tax payable is proposed u/s 87A, if opted for new tax regime. If opted for the old Regime the limit is up to Rs 5 lakh of Income.

- Conversion of Gold to Electronic Gold Receipt & Vice Versa :

It is proposed that the conversion of gold from physical form into electronic form by a SEBI registered vault manager will be excluded from the definition of ‘transfer’ for capital gains purposes.

For the purpose of computing capital gains, it is also proposed that the cost of acquiring the Electronic Gold Receipt be considered the cost of gold in the person whose name the EGR is issued, and the holding period will include the period during which the assessee held gold before it was converted to electronic gold receipts. Similarly, provision for conversion from gold to EGR is also proposed.

(I will soon write a detailed article on EGR, for further clarity)

- Removal of exemption from TDS on payment of interest on listed debentures to a resident

As per current rules (Section 193), NO TDS gets deducted on the payment of interest on securities issued by the company in demat form and is listed on the stock exchange. But after experiencing under reporting, government has proposed to apply TDS on this payout w.e.f 1st April 2023

- TDS on Net Winnings in Online games

New Section 194BA as been inserted applicable w.e.f 01st July 2023, to provide

for deduction of tax at source on net winnings in the user account at the end of the financial year.

In case there is withdrawal from a user account during the financial year, the income-tax shall be deducted at the time of such withdrawal on net winnings comprised in such withdrawal.

In addition, income-tax shall also be deducted on the remaining amount of net winnings in the user account at the end of the financial year. The rate prescribed to tax net winnings in online games is 30% as per new section 115 BBJ

Sections 194B and 194BB also have been amended , which covers winnings from lottery, card game or crossword puzzle or other name of any sort. The amendment is to deduct TDS on the winnings exceeding Rs 10000 or in aggregate of Rs 10000 or above

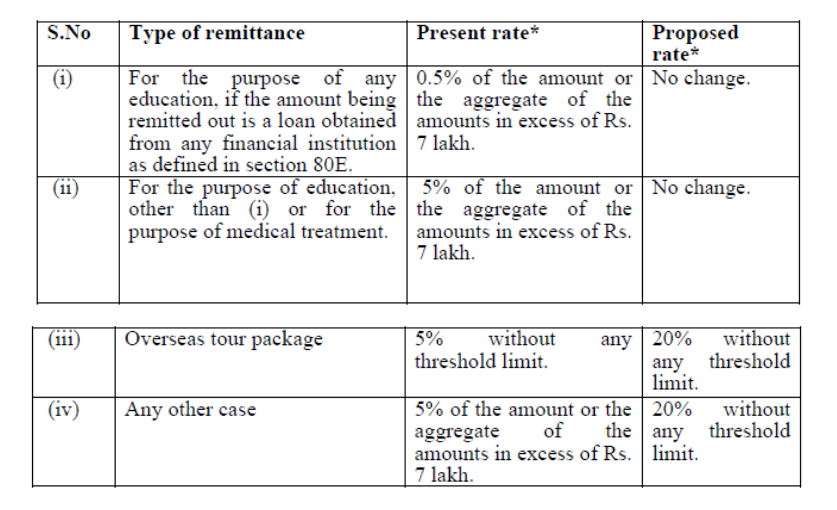

- TCS on foreign Remittances

Earlier the TCS was applied only on the remittances for certain transactions above a certain limit. But Now it is proposed to apply TCS on all the remittances . TCS on buying overseas tour packages has been increased from 5% to 20%

- Limiting the benefits on Section 54 and 54F

These sections are meant for provisions towards saving capital gains tax on sale of residential and non residential properties. It has been proposed that one can only Invest a maximum of Rs 10 crore in new residential property to save taxes under these sections. Any gain over and above this limit can’t be saved and thus fully taxed

Applicable w.e.f AY 2024-25

- Taxation of Market Linked Debentures

Government has noticed the tax leakage happening on debt securities structured under Market linked debenture products and thus announced that any capital gain booked under such products will be treated as Short term capital gain (Section 50AA)

Further, it is also proposed to define the ‘Market linked Debenture’ as a security by

whatever name called, which has an underlying principal component in the form of a debt security and where the returns are linked to market returns on other underlying securities or indices and include any securities classified or regulated as a Market Linked Debenture by Securities and Exchange Board of India.

Applicable w.e.f AY 2024-25

- Tax on Life Insurance Policies

The benefit of Tax free income on Life insurance policies u/s 10(10d) has been removed for the policies having premium of Rs 5 lakh and above. Applicable on the policies bought on or after 1st April 2023.

And it is also made clear that the gain will be taxed as “Income from other sources”.

If the premium paid had been claimed as deduction in any other provision of the Act such premium will not be reduced from sum received.

This would not apply to ULIP or Keyman insurance policies whose taxation is governed by other existing provisions of the Act

ULIPs above Rs 2.50 lakh of premium (Single or in aggregate) already made taxable last year. And this year the other policies also have been brought under tax net.

- Prevention of double deduction claimed on interest on borrowed capital for acquiring, renewing or reconstructing a property

Some assessee paying home loan EMIs (for acquiring, Renewing or reconstructing), claim the interest outgo u/s 24 , and also add the interest paid into the cost of property and thus claim benefit at the time of selling the property. This results in double deduction of the same amount

In order to prevent this, it is proposed that the cost of acquisition or the cost of improvement shall not include the amount of interest claimed under section 24 or Chapter VIA.

- TDS on EPF Withdrawal Reduced

If an employee withdraws accumulated EPF balance before completion of 5 years of job, then the withdrawal amount is taxable and the department is required to deduct TDS@10% of the amount, Provided the employee has furnished his/her Pan card.

In case of Non Pan cases, TDS to be deducted at Maximum Marginal Rate.

Now it is proposed to reduce the TDS rate in case of NON PAN cases to 20%

Amendment will take effect from 01 April 2023

- Limits enhanced in Small Saving Schemes:

The maximum deposit limit for Senior Citizen savings schemes will be enhanced from Rs 15 lakh to Rs 30 lakh. Means if a senior citizen couple like to invest in this scheme they can together invest Rs 60 lakh through separate accounts. Recently the interest rate in this deposit scheme has been raised to 8%

Even for Post Office Monthly Income Scheme (POMIS), the deposit limit has been enhanced from Rs 4.5 lakh to Rs 9 lakh for a single account, and from 9 lakh to Rs 15 lakh for joint account.

- Leave Encashment Limit Raised:

For Non Government Salaried Employees, the tax exemption on the leave encashment has been increased to Rs 25 lakh.

Conclusion:

Frankly, there is nothing to conclude 🙂 This is what it is and we need to work onto our Money management to see where the impact is coming and need to take required measures. Understanding the announcements will help you do your tax planning in April (The start of next financial Year).