As the name implies, a Gift Tax is a tax on gifts received. The recipient of a gift is responsible for paying gift tax. To compute the gift tax, even if the gifts are received in kind, the monetary values of the gifts are also taken into account.

A common family practice involves husbands investing in the name of their spouses in the belief that it will help them save taxes on Investment Income. GrandParents are seeing investing in grandchildren’s names under love and affection. Family members and friends exchange Shaguns on special occasions like birthdays, weddings, or festivals.

The Income Tax Department considers all of this as a Gift unless you give another name to it like a loan in some instances, or it could be a business transaction.

The definition of a gift according to Wikipedia is an item given to another without expecting to receive payment or return. The item cannot be considered as a gift if there is a reasonable consideration, either in cash or in kind. The onus of proving the source and nature of funds lies with the recipient pursuant to the Income Tax Act.

In accordance with the Gift tax rules, certain gifts received from Specified relatives do not attract any tax. All gifts you receive from Blood Relatives can be claimed as tax-free in the hands of the receiver.

In the case of gifts from non-relatives, the exemption is only available up to Rs 50,000 in a year, and any amount received over that amount will be taxable and included in the total income of the receiver.

Thus if Gift tax rules are followed wisely, then one can create different tax files in a family and save considerable taxes.

Gift Tax in India – Rules:

In India, the Gift tax is governed by section 56(2) vi of the Income Tax Act, which states that if the value of a gift received exceeds Rs 50,000 in a financial year, it will be included in gross total income and taxed under other sources of income. The following provisions apply to calculating the value of the gift:

- If gifts are received in cash:

When the total receipts in the form of cash gifts exceed Rs 50,000 in a financial year, the total receipts will be taxable. If the receipts exceed Rs 50,000 even by Rs 1,000, the full amount would be added to the gross total income and taxed according to the income tax rates.

- If gifts are in form of movable property:

The figure of Rs 50,000 will also apply here. Gifts that are given without consideration and have a fair market value of more than Rs 50,000 will be taxable. With a gift that has a consideration but is less than fair market value and the difference is over Rs 50,000, the difference between fair market value and consideration will be taxable.

- If the gift is in form of Immovable property:

The stamp duty paid on a property given without consideration is considered the gift value if the payment exceeds Rs 50,000.

If the property is gifted with consideration, then the difference between the stamp duty value and the consideration or purchase price will be considered the gift value.

Taxing gifts seems unfair, doesn’t it? Since gifts are given and received out of love and affection, they shouldn’t be subjected to taxes. In response to this discontent, the income tax act provides some exemptions in gift tax in India rules. These are as follows:

Gift tax in India – Exemptions

Under the following conditions, there would be no gift tax in India:

- A gift of less than Rs 50,000 in a financial year is not subject to gift tax, and the entire amount is tax-free.

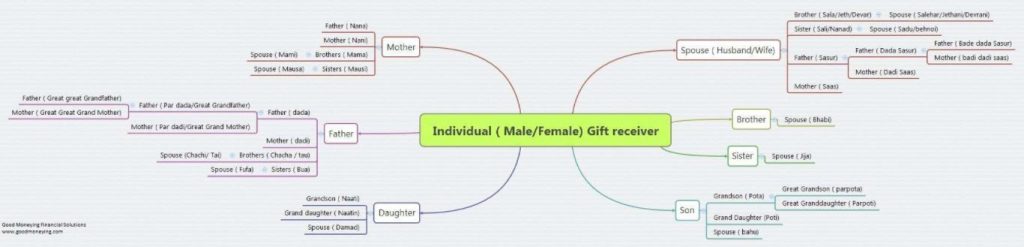

2. Amounts received from specified blood relatives are not taxable. The term relatives are defined as follows:

a) Spouse

b) Brother or Sister

c) Brother or Sister of Spouse

d) Brother or Sister of either of your parents

e) Any of lineal ascendants or descendants

f) Any lineal ascendant or descendant of Spouse

g) Spouse of the persons referred above

Here is a chart that explains which relationships qualify for tax-free gifts. Click on the image to enlarge.

How Doctors may use Gift Tax rules to Save Income Tax?

- Gifting to Children:

Your children can help you save on taxes in a significant way. As long as they have not started earning, their tax file is completely blank, and you can fill it up by gifting them your money to be invested in safe and taxable instruments.

Suppose for example that you have parked the child education fund in fixed deposits with a bank or in debt funds, which could be invested in the child’s name.

In this way, any interest and capital gains earned will be on the child’s account. As long as the child has no other income, then the child can take advantage of the basic tax slab. (Also Read: New or Old Income Tax Slabs, what doctors should choose?)

The Income up to Rs 2.50 lakh ( as per Income tax rules 2021-22) will be tax-free, and over and above this, You may invest Rs 1.50 lakh in section 80C instruments to save tax. (Also Read: List of All Expenses and Investments qualified for deduction under section 80C)

If your child is a minor, then also you can benefit from gift tax rules, at least for the amount you want to use for the child when he becomes an adult. Money can be invested in a mutual fund (a Capital Asset) in the name of the child and withdrawn only when the child becomes an adult.

Unlike Interest Income which is accrued and taxed every year, Capital gains get taxed only when the investments are sold.

You should also know that if funds are invested in interest-bearing instruments on behalf of a minor child, the interest income will be Clubbed back to the parents’ income.

However, since PPF and Sukanya Samriddhi generates tax-free interest, they may be used for this purpose. (Also Read: Is PPF a good long term Investment for doctors)

2. Gifting to Parents:

Using the gift tax rules can also help you save on your taxes if your parents are in a lower income bracket than you.

Taxable investments may be made in their name, so the taxation falls on their tax file.

So for instance, you may invest the emergency fund money in their bank account or an FD or liquid fund in their name, in order to avoid the tax liability incurred in your name when withdrawing from those investments.

And just like the example of a major child, you may enjoy the basic exemption or lower tax rate benefit of your parents.

It would be better for you to be a joint owner of all the investments in both points above to manage the money in a better way. Especially in Parents’ case, it is important to make sure their estate planning was done properly so that future distribution issues can be avoided.

3. Gifting to Spouse and daughter In-law:

It is a general notion in families to invest in the name of Non-Working/Low Income earning Spouses with the idea that the income from those investments will be included in their income, which is incorrect.

In accordance with gift tax rules, gifts to spouses or daughters-in-law are tax-free in their hands, but if the money is invested, then the income becomes taxable in the hands of the giver.

Ideally one should not gift money to a spouse or daughter-in-law. If a gift is necessary, it should either be invested in a PPF or any tax-free/efficient instrument.

Taking into account the perspective of Tax Planning, if one wishes to improve or create a tax file for a spouse, then the wedding gifts should be added to her account. Gift tax rules exempt gifts received at the time of a wedding. (Also Read: Tax Planning tips for doctor couple)

4. Gifting to HUF:

Don’t be discouraged if your kids are too young, and your parents are also in a high-income bracket – you can create your own Family tax file, which is a Joint family account and is treated as a separate tax entity under Income tax rules. This is known as Hindu Undivided Family (HUF).

Gifts made to HUF by its members are tax-free in the hands of the HUF. As a new tax entity, the HUF will be able to enjoy all the exemptions and benefits that apply to individuals.

Please be aware that this will be a family account and money put into it will be treated as family money, which cannot be bequeathed by the Karta. However, HUF can be partitioned.

Before forming a HUF, it is important to understand the rules. If you can see any significant benefit, then only go for it, else you will complicate your personal finances.

Conclusion:

Doctors are very High earning professionals. It is very important for them to understand such rules which they can use to reduce their overall tax outgo.

Family gifting, if within gift tax rules, can be an effective tool to distribute and manage wealth. Besides helping in some tax savings, Gifting can also be used as a good estate planning tool.

Nevertheless, whatever you do should be a genuine transaction and should not appear to be an attempt to avoid taxes.

When used wisely, gift tax rules can assist in legitimate tax planning. (Also Read: Tax Planning tips for young doctors)

Along with Gift tax rules, you should invest in tax-efficient instruments, so if at all money gets taxable in your hands, you should not be penalized (Taxed) much.