Public Provident Fund or as it is popularly called PPF is one of the best debt investment instruments available in India. It suits every kind of investor for one’s debt portfolio.

And for a Busy profession like doctors who are more prone to be missold with some traditional insurance policies by their bankers or relatives, should always consider PPF as their first and Primary long-term debt Investment.

Map it with your retirement, or Child education, Wedding, or any other long-term goal, this tax-free instrument will surely help in supplementing your savings.

The Tax-free return backed by government guarantees makes it more attractive for investors. And its eligibility for tax-saving u/s 80C is the icing on the cake. All these features have made PPF a darling investment option. (Also Read: All qualifying investments and expenses under section 80C)

Through this article, I will discuss with you the basic features of this product, the latest changes announced, and why or why not one should consider investing in this.

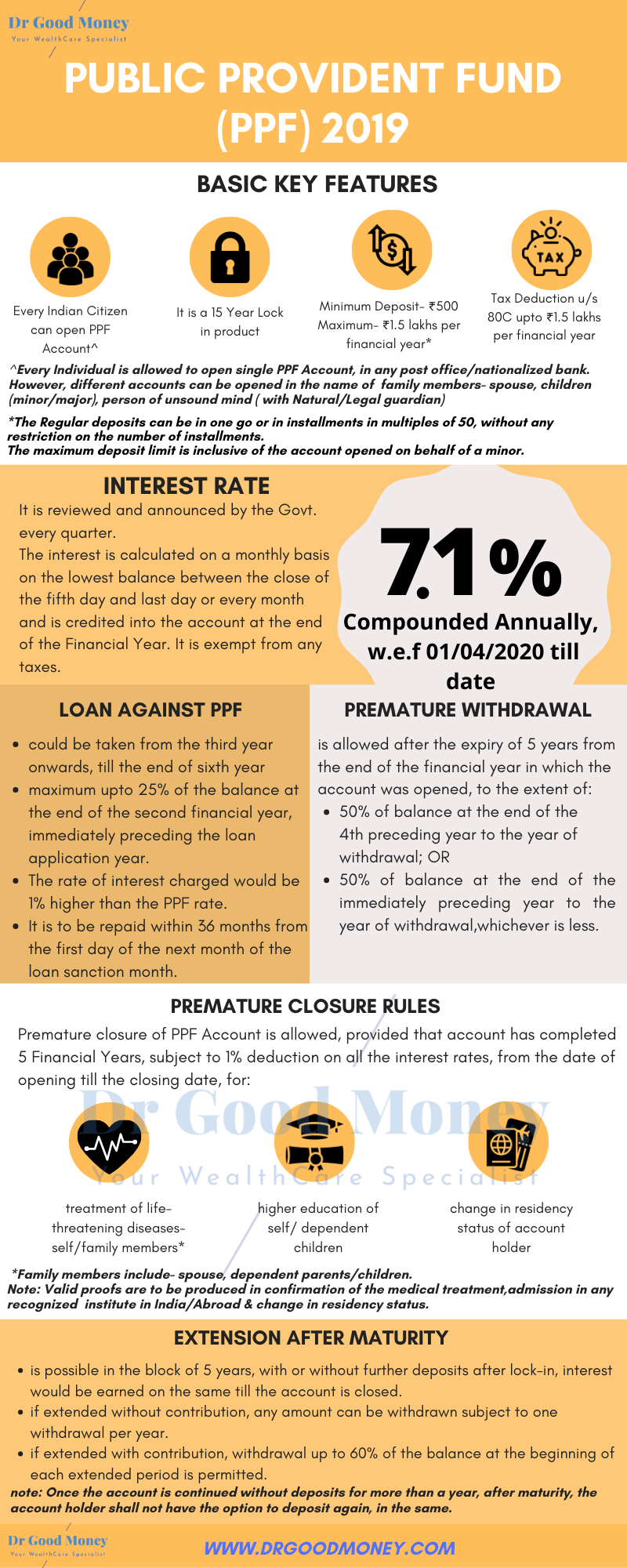

Basic Features of PPF (Public Provident fund):

I have tried to enlist all the basic features of the Public Provident Fund in this infographic below. I have also included some of the latest changes related to PPF in 2019.

I have participated in a Discussion over PPF in Jagran Dialogues, organized by Dainik Jagran Team. You may watch it below.

Other Important Features of PPF:

- If in any financial year, a minimum deposit of Rs.500/- is not made, the said PPF account shall become discontinued. However, interest would be continued to accrue. In order to revive the discontinued account, you have to pay the penalty fee of Rs 50/- for each year of default along with subscription arrears of Rs 500/- per Financial Year.

- PPF account is easily transferable between post offices or banks, even between post offices and banks.

- NRIs are not allowed to open PPF accounts. And as per the notification issued in October 2017, if they have one PPF account while being in resident status, then the PPF account will stand closed from the day they turned into NRI.

- The balance amount in PPF account is not subject to attachment under any order or decree of the court in respect of any debt or liability, but it can be attached by the Income Tax and Estate Duty authorities.

- Nomination facility is also available.

Why is PPF a Good Investment Option for Doctors?

As I said at the beginning of the article, sometimes due to lack of time, and many times due to the search for safe products, Doctors get missold by their bankers or other product sellers with the Traditional Endowment Insurance policies.

These policies are good for the product sellers but not for the buyers, due to low returns and high expense structures. So PPF with an EEE structure and decent interest rate structure is a very attractive option.

No doubt, the Exempt- Exempt-Exempt (EEE) status of Public Provident Fund i.e., the invested amount, interest earned and the maturity proceeds all are tax-free, makes it a “Must have” investment account in one’s portfolio.

The early you open this account, the early you will get over with the lock-in period. Sovereign Guarantee ensures the safety of capital and steady returns as well. Premature withdrawal, closure, and Loan Facility is an added advantage (although not advised).

PPF is a very long-term investment and is suitable for long-term goals like- retirement and can be a part of the Debt Allocation of the investment portfolio. (Also Read: Asset Allocation- the balanced diet to your investment portfolio)

With the interest rates being linked with the Government Security yield, it may change every quarter. So, if you have limited money to invest in you may mix it up with short- or long-term debt mutual funds (as the case may be depending on the interest rate cycle) to have a better returns arrangement. But with a good surplus available you may use this product to its full.

Last but not the least, before getting into such long-term products, you have to have basic financial hygiene in place like- keeping an emergency fund, buying required insurances, etc. so you should not get tempted or forced to look out to redeem your investments.

Also Check: Should Doctors opt for the New Pension Scheme (NPS)?