In Budget 2020 FM announced a proposal of a new Income tax rates regime where all salaried persons not having income from Business or Profession, including Doctors can opt for and calculate the income tax liability in a simpler way without going much into the technical calculations.

This was with a caveat that if opted then he/she would have to forego all the exemptions and Deductions which he/she otherwise could opt-in existing or (now) old income tax regime.

Since salaried doctors employed in hospitals are asked to declare their savings structure at the beginning of the financial year so the employer (in doctor’s case the hospital administration) can start deducting the TDS from the same, this time he would also be asked which tax regime he/she wants to opt for.

Though if you have not thought over it and just checked any option in the declaration sheet, don’t worry. You may calculate and pay the taxes, as per the choice of your regime, when you do your self-assessment at the end of the year.

But in Union Budget 2023, government has cleared its intention to popularize the new tax regime and introduced few changes in it. Also, have made this new slabs as a default slab rates for the calculation of tax for salaried employees with effect from 01.04.2023. This means if someone does not specifically tell employer to opt for the old regime, the TDS will be deducted on the calculation based on the new tax regime with the new rates only.

This article is to apprise you with the changes and the difference between the new and old regime. plus a calculation based on assumed numbers to make you understand how the Maths actually work

Let’s Understand the option first so as to help you chose better.

Old Tax Regime – Income Tax Rates

| Taxable Income (Rs.) | Slabs |

| Up to Rs 2.50 lakh | NIL |

| 2.50 lakh – 5.00 lakh | 5% |

| 5.00 lakh -10.00 lakh | 20% |

| Above 10 lakh | 30% |

*If Income is up to Rs 5 lakh only then section 87A Rebate can be claimed. **Basic tax exemption Slab for Senior Citizen (Above 60 years) is up to Rs 3 lakh; and for Super Senior citizens (Above 80 years) is up to Rs 5 lakh

New tax Regime (FY 20-21) – Income Tax Slabs

| Taxable Income (In Rs.) | Tax rate |

| Up to 2.50 lakh | NIL |

| 2.50 lakh – 5.00 lakh | 5% |

| 5 lakh -7.50 lakh | 10% |

| 7.50 lakh – 10.00 lakh | 15% |

| 10.00 lakh – 12.50 lakh | 20% |

| 12.50 lakh – 15.00 lakh | 25% |

| Above 15.00 lakh | 30% |

New Tax Regime (FY 2023-24 onwards)

In the Union Budget 2023, FM has Introduced The New Tax Regime

| New Tax Slabs (in Rs.) | Rate of Tax |

| 0-3 lakh | NIL |

| 3 lakh – 6 lakh | 5% |

| 6 lakh -9 lakh | 10% |

| 9 lakh -12 lakh | 15% |

| 12 lakh -15 lakh | 20% |

| 15 lakh and Above | 30% |

The surcharge rates for old regime is left untouched and thus Taxpayers with income between Rs 50 lakh and Rs 1 crore will continue to pay 10% surcharge on the tax. The surcharge is 15% for income between Rs 1 crore and Rs 2 crore, 25% for between Rs 2 crore and Rs 5 crore, and 37% for income over Rs 5 crore.

However, to make the new regime attractive for higher income brackets, government proposed to reduce the surcharge from 37% to 25% above 5 crore of income if assesee opt for new tax regime. Applicable w.e.f FY 23-24

Also, for Income bracket not exceeding Rs 7 lakh, Rebate of 100% of Income tax payable is proposed u/s 87A, if opted for new tax regime. Where as in the old Regime the limit is up to Rs 5 lakh of Income.

What are the Major Income Tax deductions which one can not claim in the new tax regime?

- House Rent Allowance

- Standard Deduction (w.e.f FY 2023-24, this benefit will be available in the new regime calculation)

- Savings benefit is allowed u/s 80C – 80U – Like ELSS, PPF, NPS, Insurance, etc.

- Housing Loan Interest payment benefit u/s 24B

- Interest Income u/s 80TTA and 80TTB (For Senior citizens) benefit.

- Education Loan Interest u/s 80E

Looks like a Big List of benefits to forego…Right?

But the point here to note is that Not all the benefits are being claimed by every taxpayer.

Some are living in their own house with no home loan. Everyone does not have an Education loan liability. All may not like to save u/s 80C or may not want to save this year to keep the liquidity intact.

WHICH OPTION SHOULD YOU CHOOSE WILL DEPEND ON THE COMPOSITION OF YOUR SALARY, YOUR LOAN PROFILE, YOUR SAVINGS POTENTIAL, ETC. SO, ONE HAS TO DO COMPARATIVE ANALYSIS AND IF THE OLD SLAB RATES LOOK MORE BENEFICIAL, THEN YOU MAY GO WITH THEM.

Let me share an example here for better understanding:

Dr. X and Dr. Y both are resident doctors in a hospital and have the same salary structure, Dr. X claims various exemptions and deductions like- HRA, 80C, 80D, etc.

(Also Read: How Doctors can make the best use of 80C Deductions?)

But Dr. Y does not claim any deduction or exemption.

Let us first look at the Net Taxable Income in both the regimes for both Dr. X and Dr. Y.

(please note , this calculation is referring to the new changes applicable from FY 2023-24)

Now let us see the tax liability in both the cases.

Particulars | Dr. X | Dr. Y |

| Basic Salary | 18,00,000 | 18,00,000 |

| HRA | 3,00,000 | 3,00,000 |

| Medical Allowance | 50,000 | 50,000 |

| Conveyance Allowance | 50,000 | 50,000 |

| Gross Salary Income | 22,00,000 | 22,00,000 |

| Less : Exemptions | ||

| HRA ( assumed) | 2,00,000 | – |

| Gross Taxable Salary | 20,00,000 | 22,00,000 |

| Less : Deductions | ||

| Standard Deduction | 50,000 | 50,000 |

| 80 C | 1,50,000 | – |

| 80 D | 40,000 | – |

| Net Taxable Salary | 17,60,000 | 21,50,000 |

Let us calculate the Tax of Dr. X as per the Old Tax Regime and Tax of Dr. Y as per the New Tax Regime.

| Old Tax Regime Slab (in Rs.) | New Tax Regime Slab (in Rs.) | Old Tax Rates | New Tax Rates | Tax calculation of Dr. X | Tax Calculation of Dr. Y |

| 0 – 25 lakh | 0- 3 lakh | NIL | NIL | NIL | NIL |

| 25 lakh – 5 lakh | 3 lakh- 6 lakh | 5% | 5% | 12500 | 15000 |

| 5 lakh-10 lakh | 6 lakh-9 lakh | 20% | 10% | 100000 | 30000 |

| 10 lakh and Above | 9 lakh-12 lakh | 30% | 15% | 228000 | 45000 |

| 12 lakh- 15 lakh | 20% | 60000 | |||

| 15 lakh and Above | 30% | 195000 | |||

| Gross Tax | 340500 | 345000 | |||

| Add: Cess 4% | 13620 | 13800 | |||

| Net Tax | 354120 | 358800 | |||

It is very much clear from the above calculation that in this specific case where one person has done some tax savings investments, will pay less tax if opts for Old regime. But, if you look closely then there is not much of a difference and to save Rs 4 thousand of additional tax , Dr. X has done 2 lakh of savings (God knows where :))

What do you need to do?

In the New income tax rates regime, it is easy, as you just have, to have an Idea on total Income, without any deductions and benefits, and calculate the tax.

But in the Old regime, you need to apply all the available and applicable provisions and see what would be your total taxable income. (You may learn about the major deductions and exemptions available to an individual in this article). Here I have added one Income tax deductions list infographic too for an easy read.

There’s a calculator available on the Income Tax website where you can make a comparison between Old and New tax regimes and decide which option may suit you best.

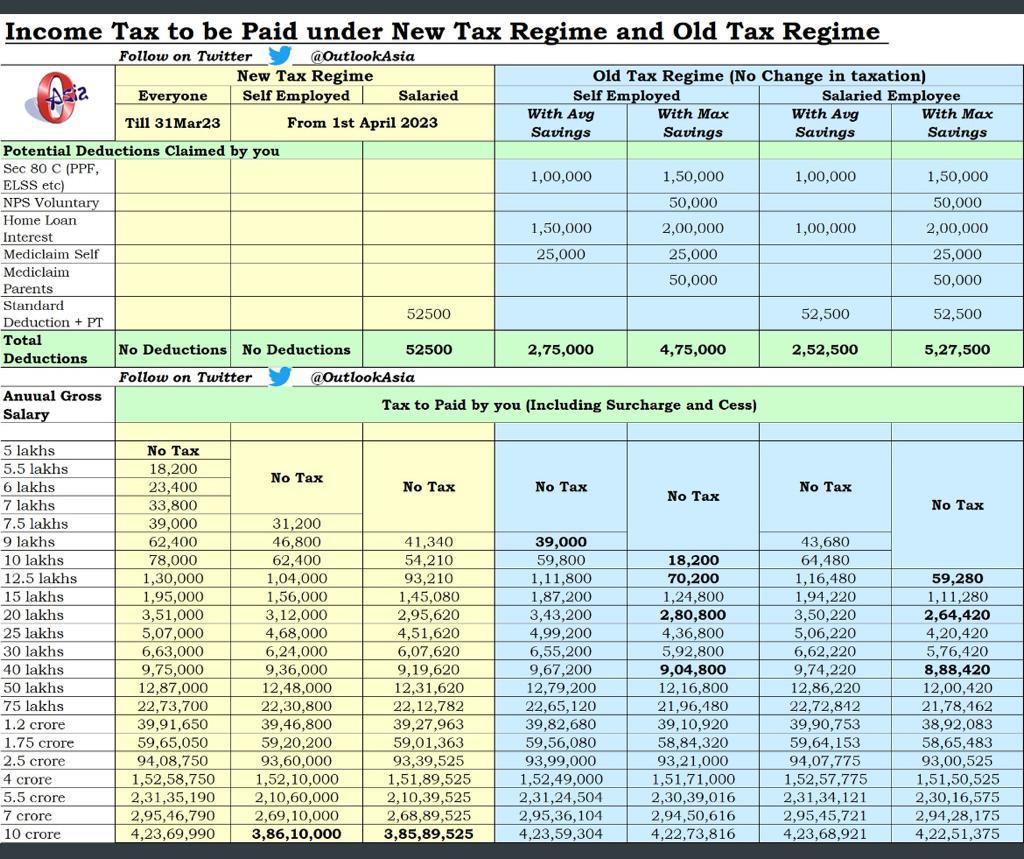

Also, a useful chart prepared by Outlook Asia, which shows the tax calculations under different income brackets in different tax regimes. Please find below

One Important thing. Even if at a later stage i.e after declaring to your hospital administration about your choice of tax regime you opt for, you feel that the other one could have been better, then do not worry. When you file your Income-tax return next year i.e. in Assessment Year, you may do the self-assessment again with the other regime of your choice.

Conclusion:

The Thought behind coming up with this new Income tax rate regime is to make things simple for the taxpayers so they need not take any professional help.

But I think that now in many cases professional help has become more important to do the exact tax calculation, so one should be able to take the benefit of all available and possible tax benefits, and choose what’s better.

But if someone wants to keep things simple, then, of course, the new one is suitable.

How do you find the old and new income tax rates in comparison? Do share your views and queries if any in the comments section.