Money, as we know it today, takes many forms – hard cash, bank balance, financial assets (equities, deposits, and mutual fund units), real estate, and precious metal. There is an emerging form of money that is gaining “currency” fast – the cryptocurrency or simply the crypto. (Also Read: Property Investing for Doctors-Why Real Estate is Riskier than Equity?)

Any currency has three basic uses:

- It acts as a medium of exchange – the government of the country gives notes and coins the status of a legal tender for exchanging them for the goods and services consumed.

- It acts as a store of value – the currency does not lose its value over time (at least it is expected not to, but it does over time with inflation).

- It acts as a unit of account – you keep accounts of the balances you own or owe to someone in currency.

Like any other country, in India, the Central Government (GoI) defines what is and is not a legal currency that is managed by the Reserve Bank of India (RBI).

Do cryptocurrencies meet any of these criteria? Are they as safe or lucrative as some of the full-page ads and prime-time ads claim them to be? Is the crypto wave passing us by and we would be a fool to not ride it?

As a Doctor, when you need to invest for the future, these and many more questions may come to your mind. With the exponential rise in their prices over the last 2 years – there are more than 8350 of them at the last count – the temptation to “invest” in them is unmistakable.

The Rise and Rise of Cryptocurrencies

The profits in both Dollar terms and Rupee terms have been huge. The oldest and the most popular of them, the Bitcoin (BTC), and its distant cousin Ethereum (ETH) have risen by over 555% (5.5x) and 2890% (29x) since January 1, 2020!

If you had invested Rs. 1 lakh on January 1, 2020, then at the time of this writing, (January 2022) your “investment” would have been valued at close to Rs. 6 lakhs in BTC and a whopping Rs. 31 lakhs in ETH! In the same duration of 717 days, the BSE Sensex moved from 41,306 to 57,011 (38%) and the NSE Nifty from 12,182 to 16,985 (39%). It means your investment of Rs. 1 lakh on January 1, 2020, would have grown to only about Rs. 1.38 or 1.39 lakhs in the broader Indian stock market.

So, as you work hard treating patients of all diseases including those of COVID-19, taking all the attendant risks, your conventional investments are not doing fine at all. Is your financial advisor not giving you the right advice to act on? Or are they smart to keep you away from a ballooning bubble that may burst any time before you even know it? (Also Read: How Doctors should choose their financial Advisor?)

The Rise is Only Half the Picture

Even if we consider them cryptocurrencies to be financial assets – by broadening our definition of the category – and not just as an alternative to currency, where does that leave us? Like any traded financial asset – other being equities, ETFs, and bonds – cryptocurrencies are also subject to market risks.

Also Check- New Age Investment Options for Doctors

The stocks of a company represent the inherent value in the earning power of the business and the assets that the business owns and the overall valuation of those two combined. In the worst-case scenario, even the share prices of a company fall, the shareholders (of direct equity and via MFs) can salvage some money by liquidating the assets. With interest rates at their historic low, the money is coming to stock markets and helping them touch new highs every now and then.

The same phenomenon of easy money is working for cryptocurrencies as well. But, in the case of cryptocurrencies, these factors are also missing. Meaning there is no cushion whatsoever for the average “investor.”

Even as a currency, cryptos are just used to park money and speculate, and are not viewed as a serious investment by most experts. Prices of cryptocurrencies (even the stable ones) can swing almost in any direction and to any extent just by hearing any news.

The volatility in the price of any cryptocurrencies can be seen from the following examples:

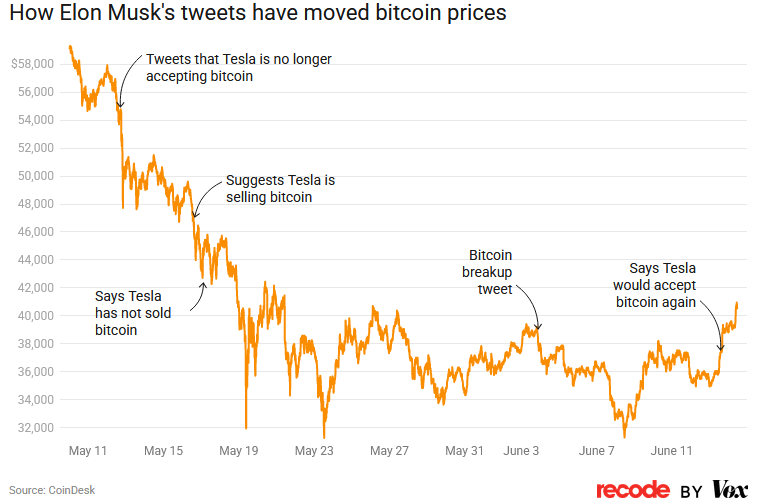

- The tweets from Elon Musk, CEO and Founder of Tesla Motors, in early 2021 that Tesla will accept BTC for selling its cars soared the interest and the rates. The following chart on VOX shows how a single influencer can move the prices since then.

2. China had banned any activities in cryptocurrencies – mining, trading, or storing – in 2017. But it began a crackdown in earnest only in July 2021. It reiterated its stance on September 22, 2021, causing a fall of more than 85 in the prices of BTC and a similar fall in other cryptocurrencies. This article on Fortune magazine chronicles Chinese actions and the price movement of BTC.

One thing that sets equity and bond markets apart from the cryptocurrency exchanges is that they are regulated with circuit breakers on either side, to stem the emotional response of the market participants. With no such circuit breakers and regulations in cryptocurrencies, the investors must fend for themselves.

The volatility of cryptocurrencies throws the opportunity to make you filthy rich as well as to wipe out your entire funds altogether.

Also Check- IDIOT Syndrome and Your Money Management

Will Crypto Replace Legal Currencies?

That is not going to happen. At least not for the foreseeable future. The sovereignty of a country gives it the power to print and control the monetary supply in the economy. This task is delegated to the central bank (like RBI). With the power to control the money supply, a government derives its power to tax, penalize, and hand out benefits to the citizens.

If a decentralized and unregulated cryptocurrency were to take over the function of legal tender, then the governments would lose their power to tax and subsidize people. No government would ever want to do that.

Another aspect of cryptocurrencies is their so-called untraceability like cash, and speed of transaction at a global scale, like electronic money. With these two attributes, cryptocurrencies are also the main source of global terror and drug trade funding. No government would allow such activities and their funding and hence may curb or regulate the use of cryptocurrencies.

Similarly, even if cryptocurrencies become acceptable as currency, then their use as an investment would diminish and their stratospheric valuations will come crashing down. To understand the phenomenon, try imagining if anyone would store INR or USD in hard cash in their lockers in the hope that their value would rise over time. It is just not plausible, as currency is only one of the ways to park your money in it, and not a very efficient one at that.

Also Check- What is the Regulatory framework of Cryptocurrencies in India?

The Story Does Not End Here!

Does that mean that as a financially savvy and aware doctor you should avoid cryptocurrencies altogether? What if you only allocate only a part of your investment corpus – say 10% to 20% to reap the gains over a short period?

Wouldn’t it be prudent to make hay while the sun shines? When everyone is benefitting from the crypto wave, and there are “smart algos” to help me “time” my entry & exit, it couldn’t be that big a risk?

Sorry to disappoint you, there is no clear answer to these questions. Financial management and planning for individuals and their families are more dependent on many other factors than simply relying on short-term gains. (Also Read: Financial Planning for Doctors- What to expect?)

So, in the next post in our three-part series, we would focus on the issues around cryptocurrencies only. We would try to find out the answers to these questions, only based on the merits of this new “asset class” (if you can call it that). (Click here to read Part 2)