The word- Retirement may sound “Boring” to some but it’s a stage that everyone has to face sooner or later. As they say, you can run but you can’t hide.

It may be an employment stage that comes with age, or it could be a Life stage that comes with Health. or if you have planned it well, it could be the age of choice when you are in good health.

If you are into your own practice then you may never want to Retire yourself from work, or, it is also possible that your Practice is the reason which may not lead you to Retire soon.

If you are employed, then you may be seeking early retirement, or, may be, you love and enjoy your work so much that you never think of your retired self. Even after Official retirement, you may think of doing some community service or do some research for the benefit of people.

It is impossible to foretell, how your Retirement would turn out to be, but with proper planning, you may get a broad idea and work on the expected challenges which you may presume could disrupt the life you want for yourself.

Can you Retire Tomorrow? Is this about reaching an age or having accumulated enough money? Is this about money or life? Many people have different definitions of Retirement.

In financial terms, we call it a stage of Financial Freedom. This is a stage when your money inflow comes not from your Active work but Passively from your Investments.

This is a life stage when you ‘choose’ to work’, not ‘have to work’. You get to choose your work too, as then it’s not about money but your likings.

But all this happens when you have exercised your choice as you want to plan and do not like to leave it to destiny.

Why Retirement Planning for Doctors is Important?

Retirement Planning for Doctors is as important as it is for anyone else.

When we talk about Retirement, it is important to understand that we are not talking about an event Like Buying Car, or Child Wedding, or an International vacation, but a life stage that is spread across 15-20-25 years or even more. You can’t be sure how long your Post Retirement years are going to be.

Your Health Status, The Accumulated savings would define how well you would be able to enjoy those years and maintain your lifestyle

Doctors are exposed to more health risks. They are more prone to catching infection/virus when treating patients. Their Busy schedule, late working hours do not let them pay adequate attention to their own health. This may result in Forced Retirement for many. (Also Read: 5 Risks doctors are exposed to and how to manage them?)

And when it comes to savings, as I always say most doctors behave like their patients and do not differentiate between Financial Doctors (Advisors) and Financial Chemists (product sellers). (Read: How doctors should choose Financial Advisors in India?)

Plus, the General Human Behavior Biases.

Young doctors feel that their Retirement is quite far so prefer to delay savings. But when asked for Financial Freedom, they want to go Free tomorrow. This leads them to take unnecessary risky investment calls. (Also Read: In search of a multi-bagger…conversation with a doctor)

Middle-aged doctors having children are more concerned about their kids’ wellbeing and prefer to save for their future, even at the cost of their own freedom.

And when nearing retirement (as per age), the whole retirement planning may go for a toss, when you don’t find having enough to have relaxed life going forward. You may have to continue working to support your lifestyle even if you don’t like to.

Sometimes you have enough but again got mis-sold by product sellers and get into unsuitable investment products. (Read: Why Property Investing is Riskier than Equity?)

Forced Retirement and Forced Working, both are not good, when you can Plan your Life and Money well.

Why Retirement Planning should be the most important goal for Doctors? Some more reasons

Inflation: Inflation is going to hit you not only in the Money-saving years but in the Money using years too. Inflation also comes in many forms. It’s not only about your basic expenses. But your lifestyle, Medical, Education, etc. all rise faster than the normal inflation.

So, you have to account for this Inflation Risk in your Planning, and Prepare yourself for unforeseen events. Remember, Health Insurance does not take care of all your medical expenses.

No Loan for Retirement: Doctors may be considered as a Good Potential candidate for lending by bankers, during your working years. But, during retirement and in old age you would not be getting any loan.

You will have to manage from your own savings.

So, it is important to use your investible surplus wisely and consider saving for Retirement as your first choice, and for all other long term important goals there is a loan available

Retirement Planning for Doctors in India – Cost of Delay

You are among the late starters. Due to your late entry into the working life, you normally start earning late and thus saving late. This should lead you to save more (to cover up the missed years) and that too in good flexible investments with a proper plan in the place.

But normally you end up taking loans (Car, House), get into the habit of swiping credit cards which put you into a roller-coaster ride of ‘spend now pay later and you never have enough surplus to start saving.

And whatever savings you have in your initial years are Traditional Investments like PPF, Insurance policies sold to you by your bankers, or bought under the definition of “Secure Investment”. Read more on PPF here.

Some young doctors also play in Stock Derivatives, in the lure of making money faster.

Remember it is all about discipline and a balanced diet. This is what you suggest to your patients and the same applies to you in financials too. To be in the best of your financial health you have to start early, so the small steps could turn into big results.

(Read: Asset Allocation- the balanced diet to your investment portfolio)

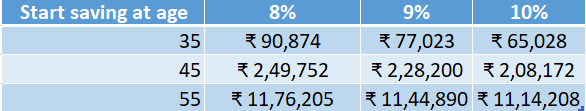

Let me share one example with you

Dr. Sambhav, 35, Lives in Indore, along with his family. His wife is a Homemaker and their child studies in Class 4. His expected retirement age is 60; Life expectancy 85;

Current Annual expenses (Basic+Vacations+Specific others) Rs 720000 (60k per month); Assumed Inflation 7%; Post Retirement Return 8%.

All this resulted in the Required Retirement corpus @60 of Rs 8.70 crore

Does the Corpus Number look high? Even Dr. Sambhav thought so. But believe me, this is correct.

With all the above numbers, Dr. Sambhav would like to know, how much would he be required to save for his goal, and what if he delays the savings for 10 years, as he wanted to buy a new car.

The above calculation shows that with an 8% p.a. return, he has to start with Rs 91k of monthly savings. Delay would keep increasing the required savings with high multiples.

Yes, you may say that doctor’s income also grows with high multiples every year. But it may not be wise to replace the savings with EMIs quoting the future income potential. There has to be a balance in your decision.

Retirement Planning for Doctors – Conclusion

Retirement is a very sensitive life stage. This is when you will not be getting your regular paycheck.

It is your choice if you like to plan it well or leave it to destiny. Good Planning may help you be Financially Free soon.

Planning gives you a better hold on to your circumstances and provides you with a holistic view of where you are, where you want to go, and guides you on how to go there.

Your Present is the result of your past, and your future will be the result of your Present. Organize yourself, have goals, and live a meaningful life.

Doctors have less time for themselves. But whatever time they have if they make use of it well and put themselves into a routine and process, things would become easier in the future.

Plus, proper Retirement Planning for doctors will save them from getting into any sort of investment or activity which is not fit for their long-term goals. A plan will put you into a discipline.

Also Check- Bucketing strategy to manage doctors post-retirement income-flow